China’s big show

Growth Target

China's leaders have a chance to reset the narrative around their struggling economy as the National People's Congress convenes in Beijing this week.

While a key briefing Premier Li Qiang normally gives later in the week has just been canceled, a lot will be divined from the annual economic growth target he will unveil when he gives his first work report Tuesday.

A target of around 5% — as expected by most economists — would be more ambitious than the same goal for 2023, which was relatively easier to pull off as it followed the pandemic-weighed 2022. And that might herald more growth-juicing stimulus is in the pipeline.

Yet Nomura economists see a "realistic chance" of a more conservative target of 4.5-5%" or "around 4.5%" due to the falling property sector and tapering of pent-up demand. Such an approach would imply less stimulus.

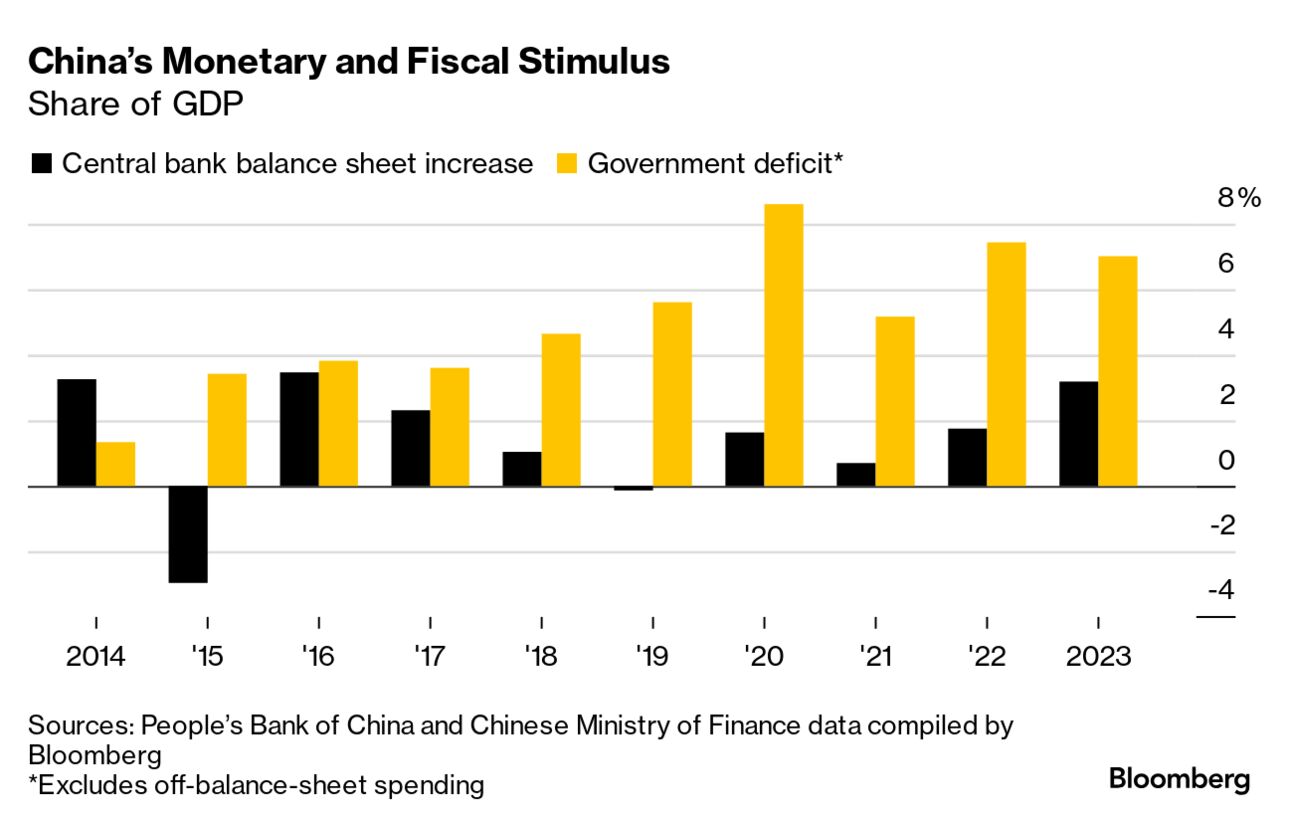

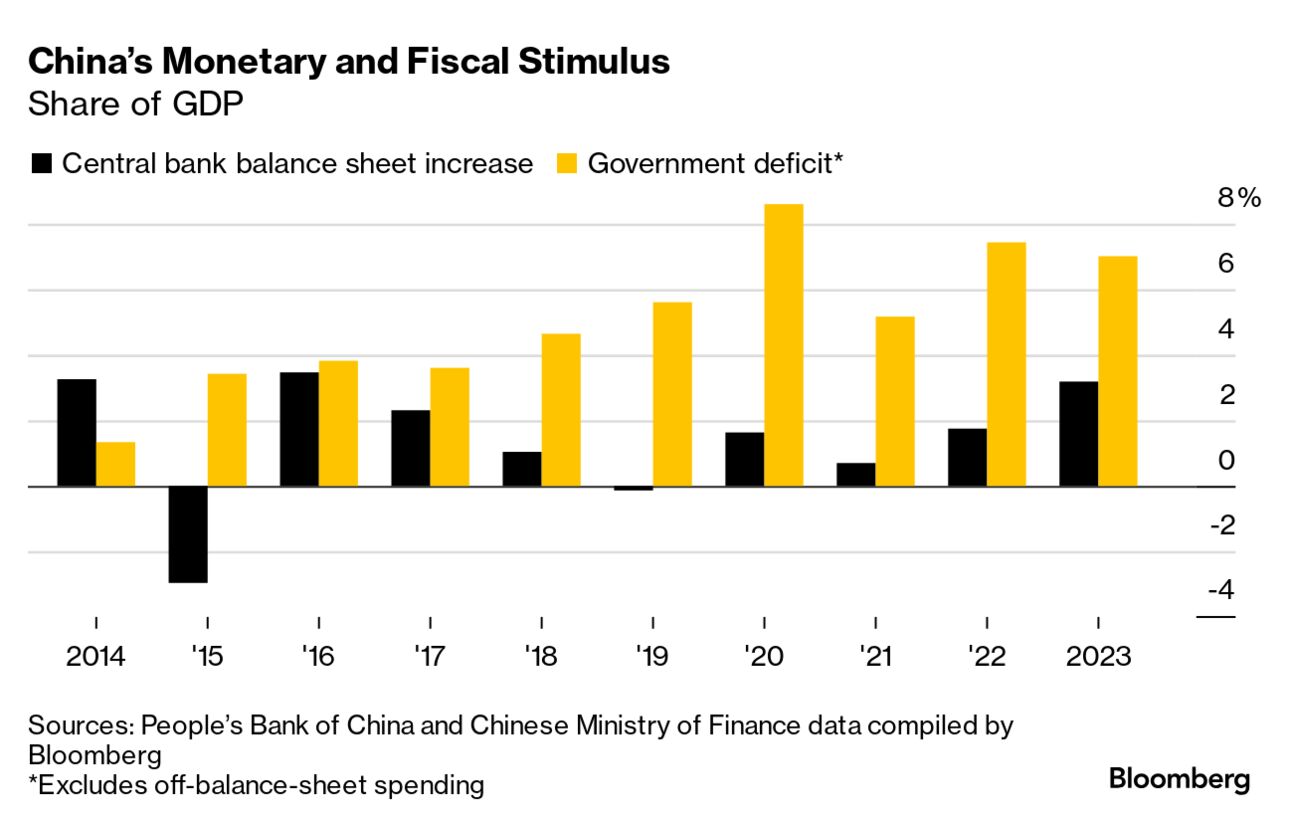

The next most important number for economists is the fiscal deficit ratio, with the median forecast at 3.3% of GDP. With China experiencing a two-speed recovery where manufacturing powers along while consumption splutters, Macquarie economist Larry Hu says policy makers may need to step up property and fiscal stimulus further if external demand wanes.

As for monetary policy, economists will need to parse set phrases for clues on the latest thinking. Bloomberg Economics says there's likely to be an easing bias even though the overall stance will remain "prudent."

The BE team anticipate a small, but important wording tweak that emphasizes aligning policy with "the expected goals of economic growth and price levels." Last year, the report didn't mention price levels, only the "nominal economic growth rate." And since China is in the grip of deflation right now, any such alignment would suggest lower interest rates ahead.

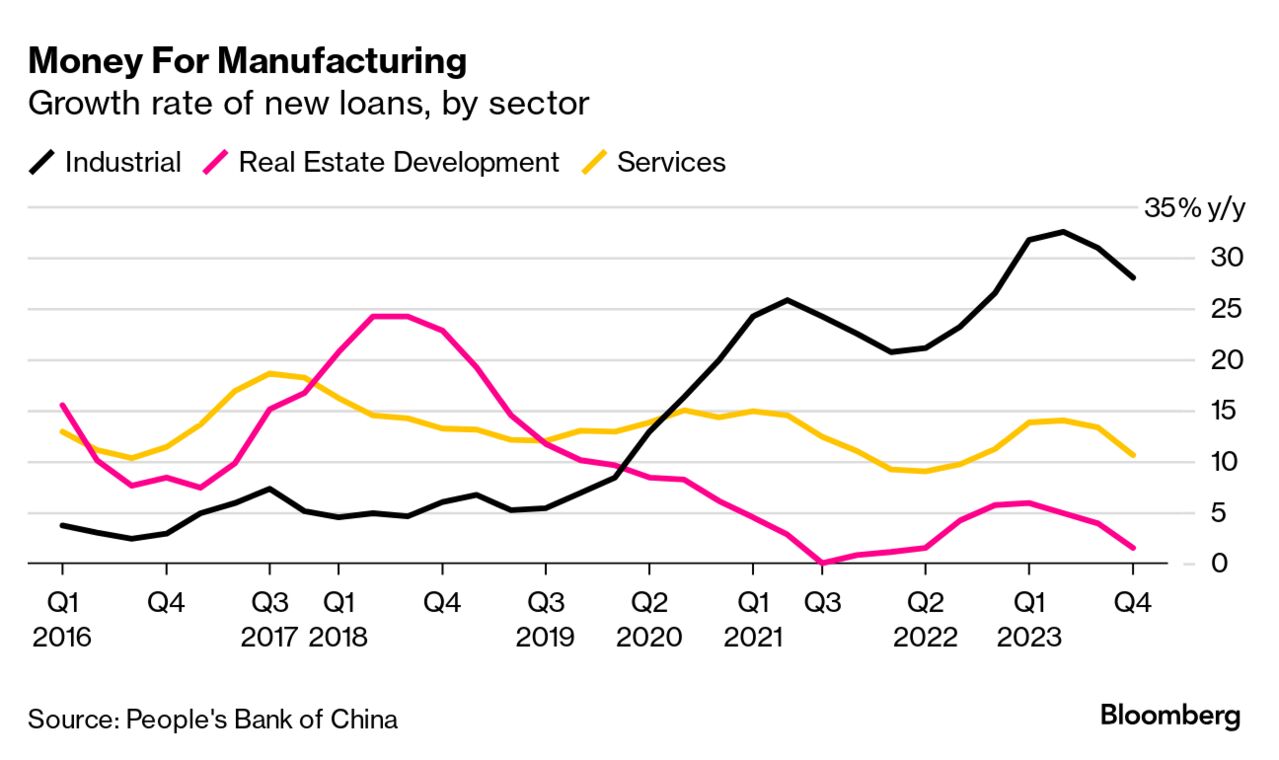

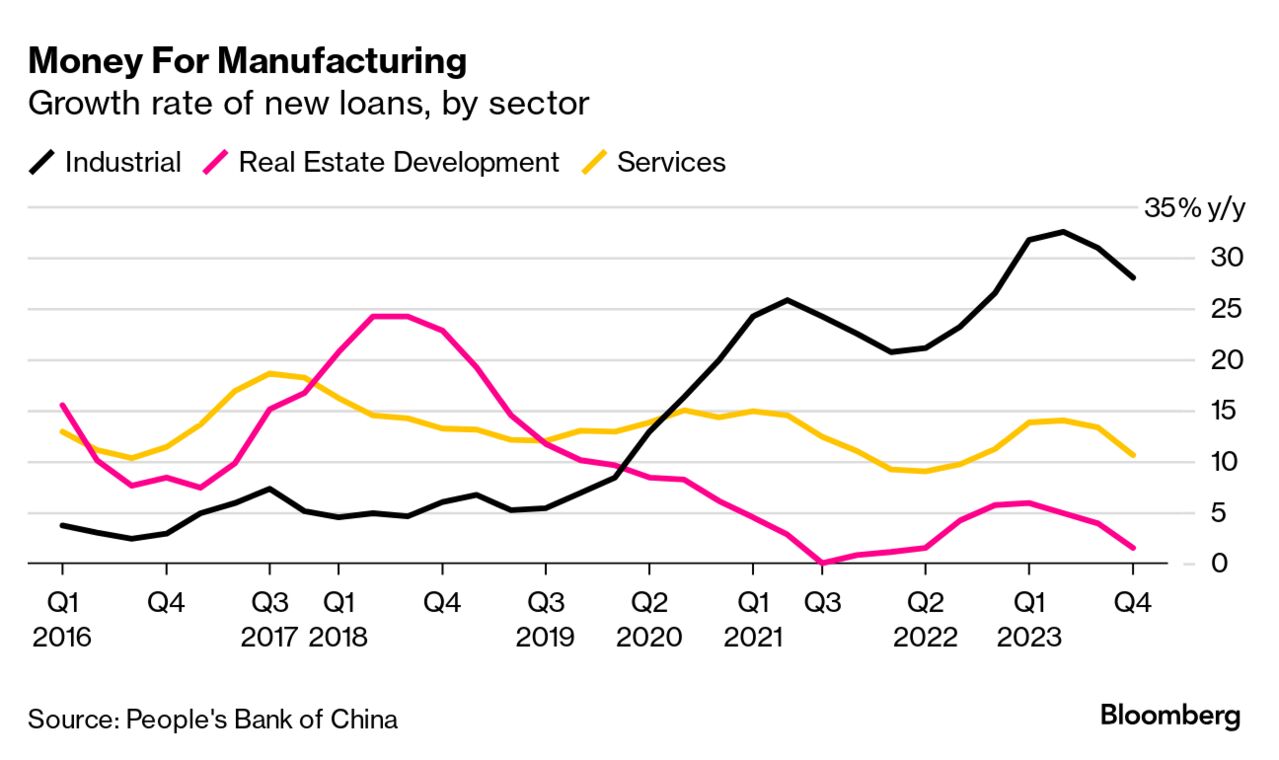

Investors will also be seeking to divine what key phrases such as the search for "new productive forces" and "high-quality growth" imply for industrial policy. The government has poured money into manufacturing, focusing on what they call the "new three" growth drivers of electric vehicles, batteries and renewable energy, but that's fueling overcapacity in these industries and raising trade tensions with the US, Europe and others.

And then there's property. Policy makers have done more to support the industry lately and announced plans to build more public housing. Putting a floor under that key sector will be crucial to revive consumer confidence.

"We expect policies to be geared toward recovery, with a larger budget deficit, a more supportive monetary policy and pledges to smooth the property correction," Chang Shu of Bloomberg Economics wrote in a note. "Failure to lift confidence would leave the economy in the doldrums."

The Week Ahead

Federal Reserve Chair Jerome Powell is expected to double down on his message that there's no rush to cut interest rates, especially after fresh inflation data showed that price pressures persist.

Powell is headed to Capitol Hill, where he'll deliver his semiannual monetary policy testimony to a House committee on Wednesday and a Senate panel on Thursday. The US central bank chief and nearly all of his colleagues have said in recent weeks that they can afford to be patient in deciding when to cut rates given underlying strength in the US economy.

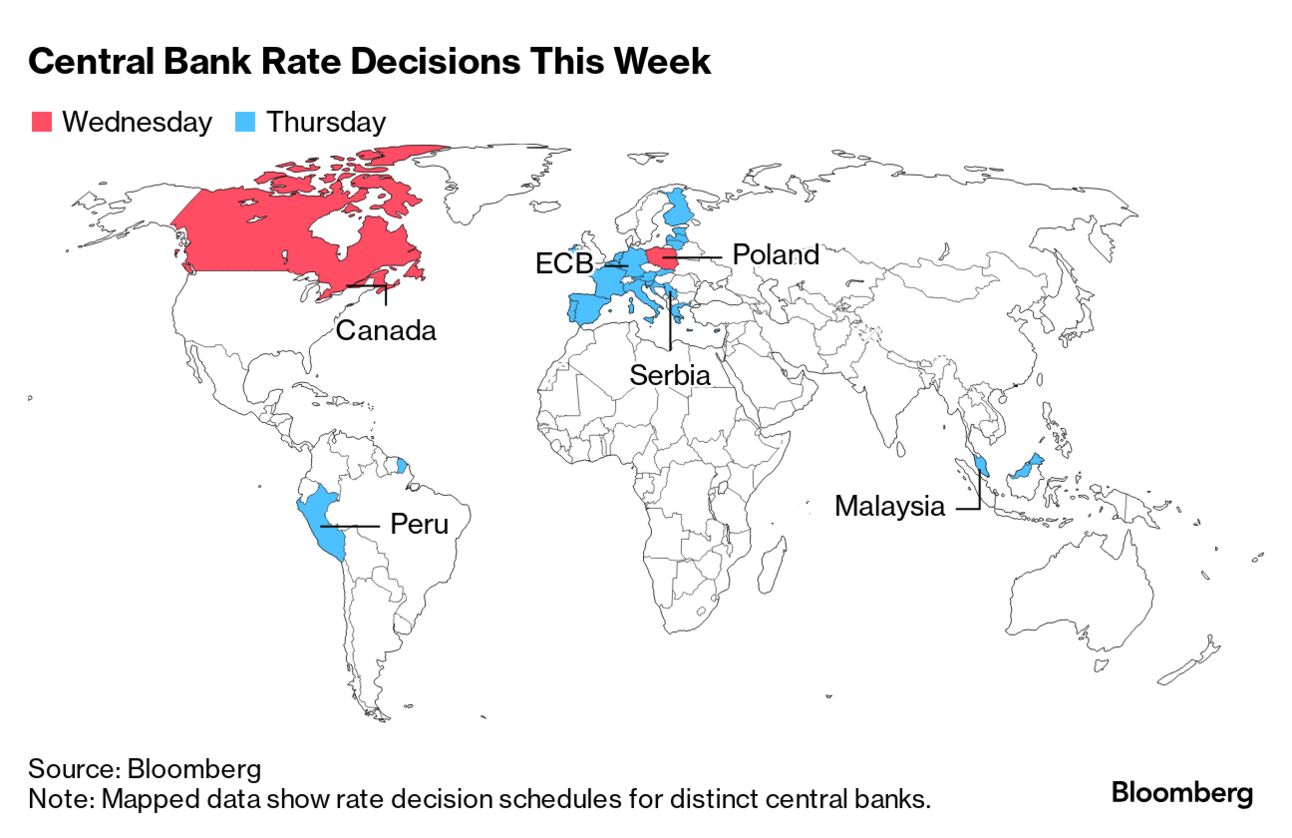

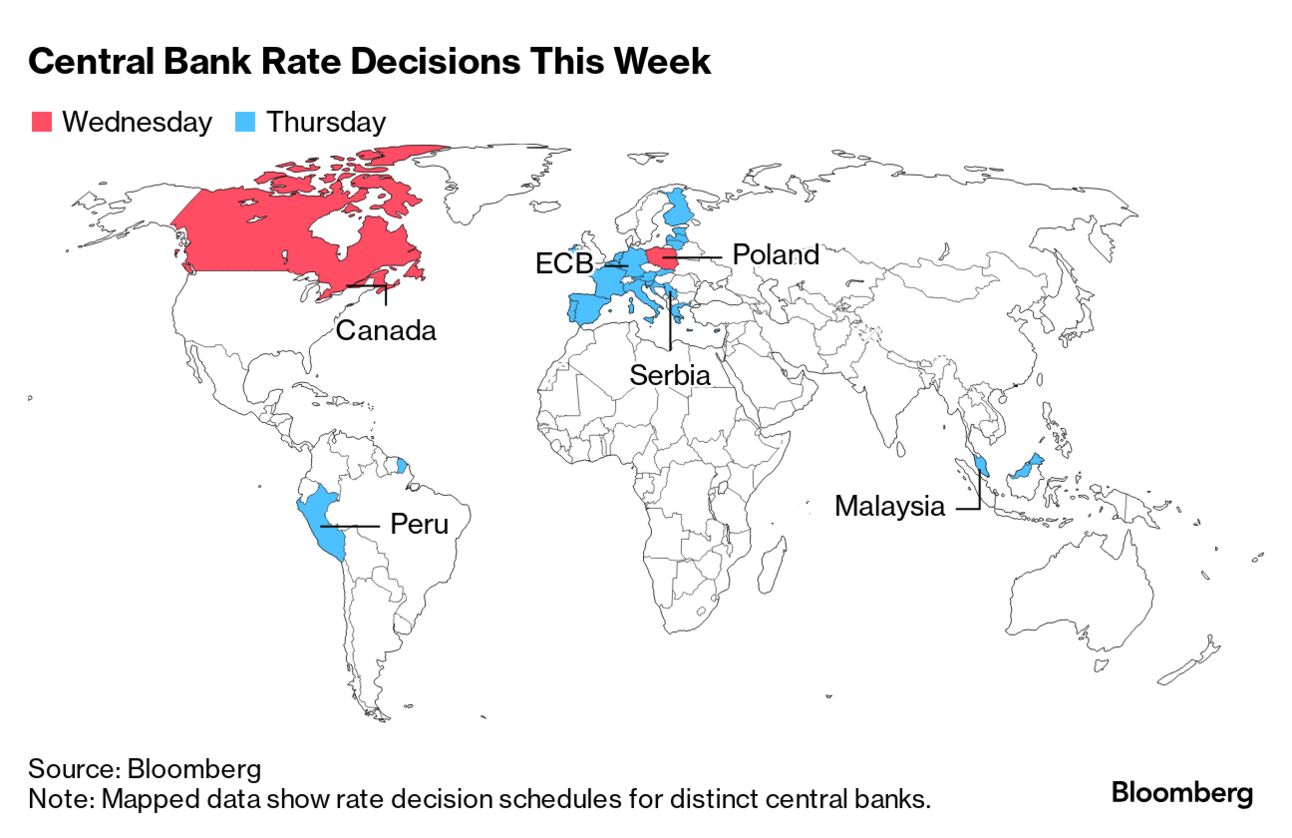

Meantime, rate decisions in the euro zone and Canada are expected to show no change. See here for the rest of the week's economic events.

The Best of Bloomberg Economics

A Harris Poll shows 75% of Americans reckon employees should stop complaining about going back to work in the office.

The World Trade Organization came under renewed criticism following a chaotic and contentious meeting of its top officials.

Narendra Modi's government wants to boost manufacturing in India.

Egypt is carrying out a feasibility study on expanding the Suez Canal.

Singapore said economic benefits from Taylor Swift's concerts outweigh incentives it state offered the singer to perform.

Thailand's central bank faced renewed calls from the government camp to start easing monetary policy.

Need-to-Know Research

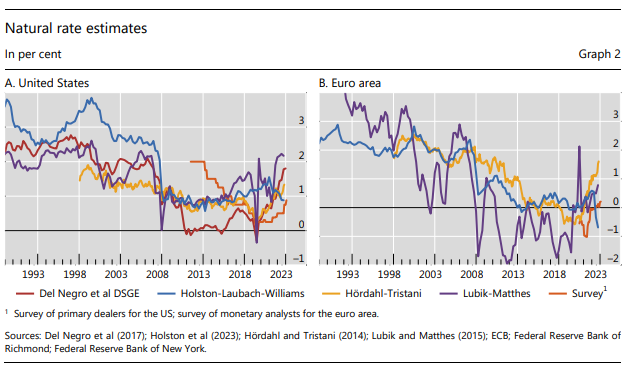

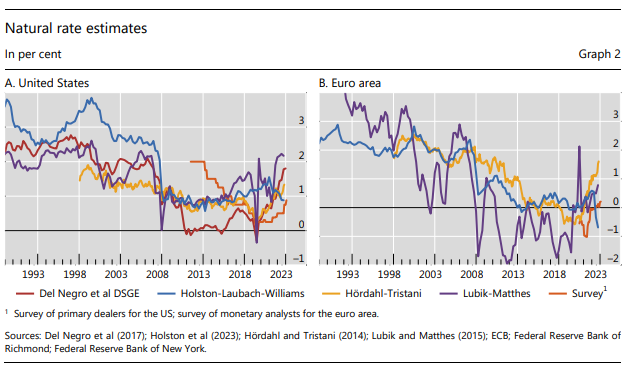

Central bank officials arguing over how easy or tight monetary policy should be sometimes center such debates on where they reckon the natural rate of interest of an economy lies.

But as Bank for International Settlements researchers explain in a study out today, there's a plethora of ways to measure R*, as it's often dubbed.

The economists reckon "R*, or at least perceptions of it, may have risen post-pandemic" — but they insist that no-one can really be sure.

"The uncertainty surrounding r* suggests that it is a blurry guidepost for assessing the monetary policy stance and hence the tightness of monetary policy, in particular at the current juncture," Gianluca Benigno, Boris Hofmann, Galo Nuno and Damiano Sandri wrote. "It appears advisable to guide policy decisions based more firmly on observed inflation rather than on highly uncertain estimates of the natural rate."

China's leaders have a chance to reset the narrative around their struggling economy as the National People's Congress convenes in Beijing this week.

While a key briefing Premier Li Qiang normally gives later in the week has just been canceled, a lot will be divined from the annual economic growth target he will unveil when he gives his first work report Tuesday.

A target of around 5% — as expected by most economists — would be more ambitious than the same goal for 2023, which was relatively easier to pull off as it followed the pandemic-weighed 2022. And that might herald more growth-juicing stimulus is in the pipeline.

Yet Nomura economists see a "realistic chance" of a more conservative target of 4.5-5%" or "around 4.5%" due to the falling property sector and tapering of pent-up demand. Such an approach would imply less stimulus.

The next most important number for economists is the fiscal deficit ratio, with the median forecast at 3.3% of GDP. With China experiencing a two-speed recovery where manufacturing powers along while consumption splutters, Macquarie economist Larry Hu says policy makers may need to step up property and fiscal stimulus further if external demand wanes.

As for monetary policy, economists will need to parse set phrases for clues on the latest thinking. Bloomberg Economics says there's likely to be an easing bias even though the overall stance will remain "prudent."

The BE team anticipate a small, but important wording tweak that emphasizes aligning policy with "the expected goals of economic growth and price levels." Last year, the report didn't mention price levels, only the "nominal economic growth rate." And since China is in the grip of deflation right now, any such alignment would suggest lower interest rates ahead.

Investors will also be seeking to divine what key phrases such as the search for "new productive forces" and "high-quality growth" imply for industrial policy. The government has poured money into manufacturing, focusing on what they call the "new three" growth drivers of electric vehicles, batteries and renewable energy, but that's fueling overcapacity in these industries and raising trade tensions with the US, Europe and others.

And then there's property. Policy makers have done more to support the industry lately and announced plans to build more public housing. Putting a floor under that key sector will be crucial to revive consumer confidence.

"We expect policies to be geared toward recovery, with a larger budget deficit, a more supportive monetary policy and pledges to smooth the property correction," Chang Shu of Bloomberg Economics wrote in a note. "Failure to lift confidence would leave the economy in the doldrums."

The Week Ahead

Federal Reserve Chair Jerome Powell is expected to double down on his message that there's no rush to cut interest rates, especially after fresh inflation data showed that price pressures persist.

Powell is headed to Capitol Hill, where he'll deliver his semiannual monetary policy testimony to a House committee on Wednesday and a Senate panel on Thursday. The US central bank chief and nearly all of his colleagues have said in recent weeks that they can afford to be patient in deciding when to cut rates given underlying strength in the US economy.

Meantime, rate decisions in the euro zone and Canada are expected to show no change. See here for the rest of the week's economic events.

The Best of Bloomberg Economics

A Harris Poll shows 75% of Americans reckon employees should stop complaining about going back to work in the office.

The World Trade Organization came under renewed criticism following a chaotic and contentious meeting of its top officials.

Narendra Modi's government wants to boost manufacturing in India.

Egypt is carrying out a feasibility study on expanding the Suez Canal.

Singapore said economic benefits from Taylor Swift's concerts outweigh incentives it state offered the singer to perform.

Thailand's central bank faced renewed calls from the government camp to start easing monetary policy.

Need-to-Know Research

Central bank officials arguing over how easy or tight monetary policy should be sometimes center such debates on where they reckon the natural rate of interest of an economy lies.

But as Bank for International Settlements researchers explain in a study out today, there's a plethora of ways to measure R*, as it's often dubbed.

The economists reckon "R*, or at least perceptions of it, may have risen post-pandemic" — but they insist that no-one can really be sure.

"The uncertainty surrounding r* suggests that it is a blurry guidepost for assessing the monetary policy stance and hence the tightness of monetary policy, in particular at the current juncture," Gianluca Benigno, Boris Hofmann, Galo Nuno and Damiano Sandri wrote. "It appears advisable to guide policy decisions based more firmly on observed inflation rather than on highly uncertain estimates of the natural rate."

No comments