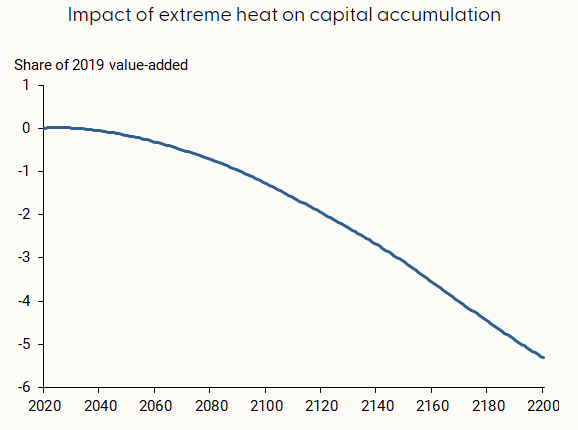

Receding prospects for the Federal Reserve to lower interest rates in the next few months are keeping US mortgage rates in the 7% range — more than double what they were three years ago. This higher-for-longer dynamic is, slowly but surely, reshaping the housing market. "Homeownership is becoming less of a middle-class dream and more of an aspirational dream that comes with above average wealth," says Daryl Fairweather, chief economist at Redfin Corp., an online real-estate firm. Renters say there's a 60% likelihood they'll never be able to own a home — that's the highest since the New York Fed started that survey a decade ago. Just 16% of listings last year were affordable for the typical American household, according to Redfin. And as if a record median $433,558 price tag for a home wasn't bad enough, insurance costs and property taxes have also spiked. That unrelenting pressure has upended major life plans for US consumers and could mean staying in a dead-end job or refusing to relocate for a better opportunity, which can affect business and productivity. It'll likely exacerbate all kinds of gaps in wealth as more people are shut out from buying houses, creating a wider chasm between those who own and those who don't. Some of the wealthier homeowners aren't going to escape the bite from high mortgage rates. More than 1.7 million homebuyers since 2019 bought properties with an adjustable-rate mortgage. Those loans — averaging near $1 million — are set at a rate typically lower than the prevailing 30-years for the first few years, then adjust based on current borrowing costs. Hundreds of thousands of those buyers have seen or will soon see their rates re-set at much higher levels. "Your payment's gonna almost double and it's not gonna be pretty," says Chris Stearns, a southern California-based mortgage loan advisor at Thrive Loans. Homeowners last month were paying some 35% of their income on housing, compared with just 29% for renters, according to real estate brokerage Zillow Group Inc. While mortgage-rate relief doesn't appear to be in the offing, supply had appeared to be a bonus: builders have been busy in recent years, and there's now a "huge number of homes for sale in the pipeline," as Steven Blitz, chief US economist at Lombard Street Research, puts it. The number of single-family properties under construction is well above post global-financial crisis levels. But the bad news is builders are now cutting back, and holding off on starting projects that have been authorized, Blitz wrote in a note Tuesday. That could limit the inventory surge over time, keeping prices high even if mortgage rates come down. That makes renting all the more compelling. As if the US housing market didn't need more problems (see above), extreme heat is set to limit construction-worker productivity, and reduce investment, over the (very) long haul, a San Francisco Fed study shows. The study projects outdoor workers' future vulnerability to heat stress, measured in days per year above safety thresholds for "heavy work." That figure is set to rise substantially, from 22 days in 2020 to about 80 by 2100, economists Gregory Casey, Stephie Fried and Matthew Gibson wrote in the paper.  Source: San Francisco Fed "We find that future increases in extreme heat would lower the capital stock by about 1.4% in 2100," they wrote. "Lower capital stock reduces the economy's ability to produce output, which in turn reduces consumption," with a loss of annual consumption of 0.5% by 2100. The authors did have some caveats, including that activity could shift to cooler places. |

No comments