Switzerland built its banking industry on a policy of taking no sides

Switzerland built its banking industry on a policy of taking no sides. Ireland, long opposed to military commitments, had none of the burdensome defense obligations that its neighbors did.

Now, as the world realigns on geopolitical axes, the states around the Persian Gulf are making a neutrality play of their own. Members of the Gulf Cooperation Council – Qatar, Saudi Arabia, the UAE, Kuwait, Oman and Bahrain – took pains not to confront Russia over its 2022 invasion of Ukraine. The region has also adopted a mostly independent stance on US-China relations and kept a hands-off approach to Israel's war with Hamas.

Saudi Arabia has received billions of dollars in investment from China's Belt and Road infrastructure program and envisions collaboration with Chinese companies to establish the county as a key hub for the electric-vehicle supply chain. Chinese executives last year even said they stood ready to "de-Americanize" the world's top oil exporter.

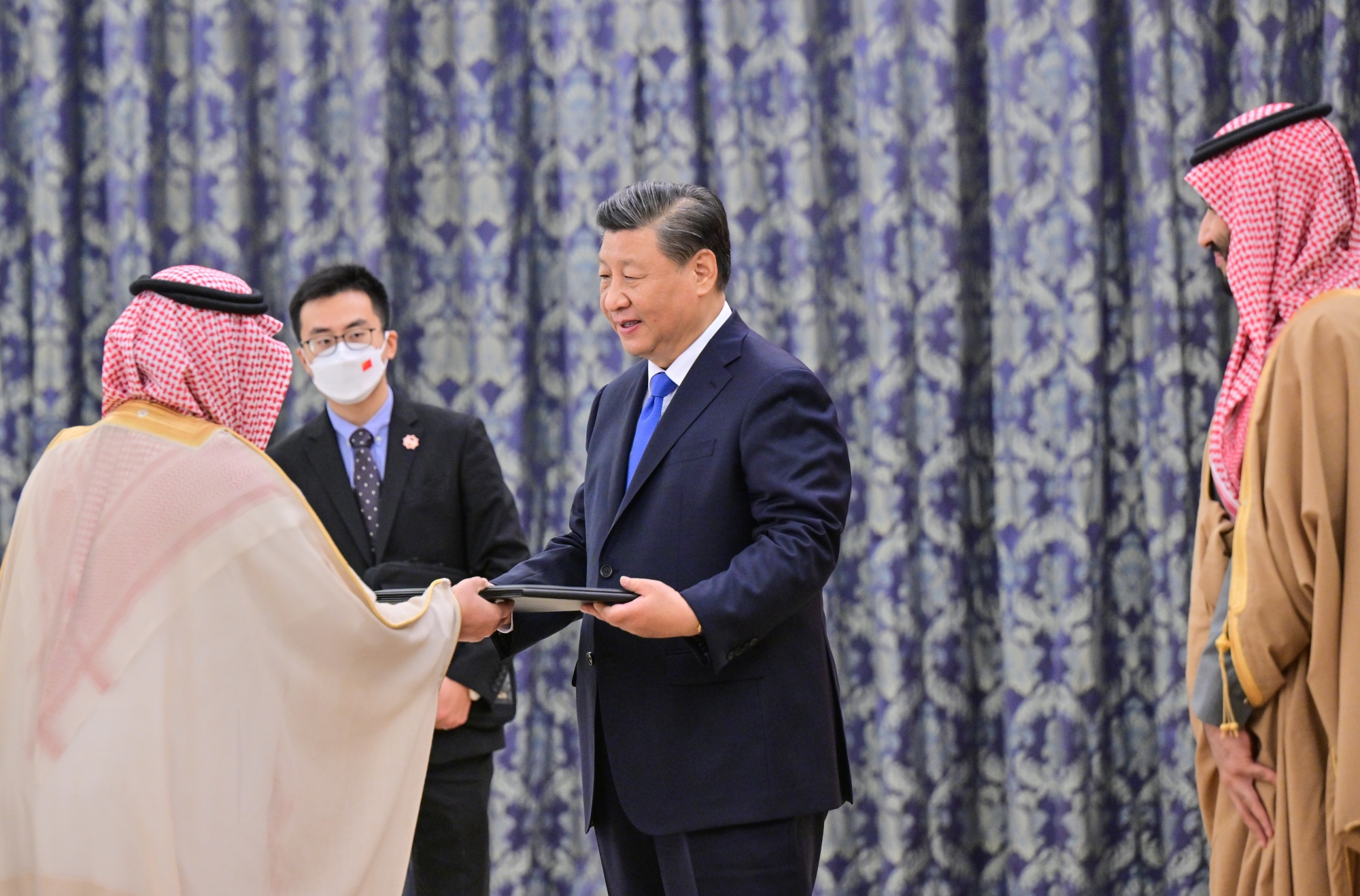

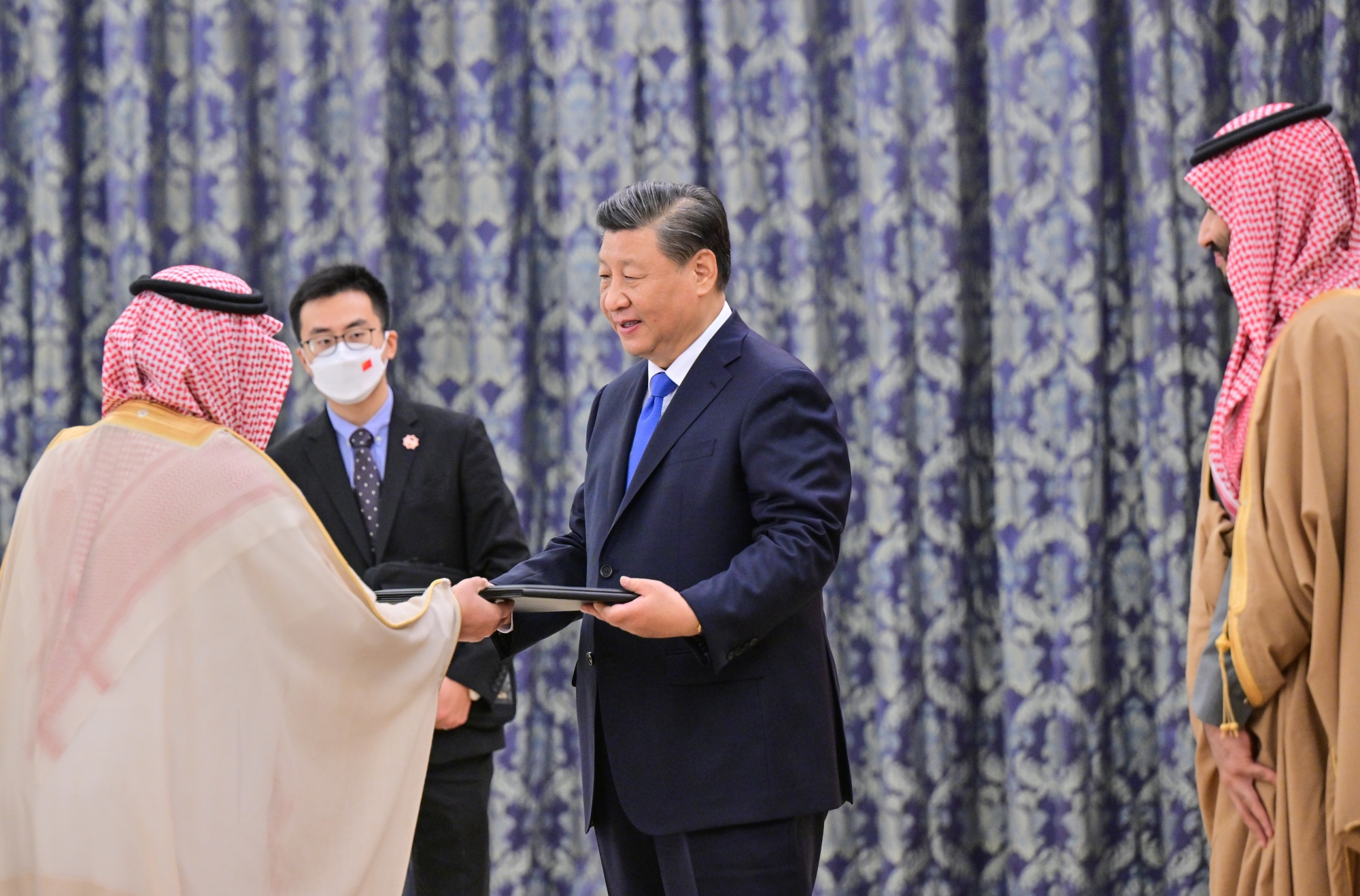

Chinese President Xi Jinping, center, at the royal palace in Riyadh, Saudi Arabia, on December 8, 2022. Photographer: Yue Yuewei/Xinhua News Agency

The neighboring United Arab Emirates has not only tightened economic ties with China but also worked with Beijing on a platform to expand the reach of the digital Chinese yuan.

As for the other key US rival, Russia, the Saudis continue to collaborate with Moscow on managing oil prices through the OPEC+ cartel. And when sanctions forced them out of Europe, Russian elites took refuge in Dubai. Even while Qatar helped Europe bear the burden of halting most Russian natural-gas imports, it also has long-term supply agreements with China.

At the same time, the Gulf countries have maintained intimate ties with Washington. For example, there's been no serious move to rethink their exchange-rate pegs to the dollar, with all the credibility that provides in the global financial system. When G42, an Abu Dhabi-based advanced-tech conglomerate with big AI plans, sought an overseas partner, it went with the US, not China.

And the region still relies on an American security umbrella — Bloomberg reported this month that Saudi Arabia and the US are even working on a historic pact that would include granting Riyadh access to advanced US weapons that were previously off-limits.

Signage at the Qatar Economic Forum (QEF) in Doha, Qatar, on May 23, 2023. The fourth annual QEF kicks off on Tuesday. Photographer: Christopher Pike/Bloomberg

Behind all the fence-sitting: a shared goal to transform the Gulf beyond its fossil fuel dependency into a trade, finance, technology and media powerhouse. That strategy – not to mention Qatar's convening power–will again be on display at the fourth annual QEF.

On Tuesday, shortly after Prime Minister Sheikh Mohammed bin Abdulrahman Al-Thani of Qatar opens the conference, the finance minister of Saudi Arabia, Mohammed Al-Jadaan, joins his Qatari counterpart, Ali Al-Kuwari, and Muhammad Al Jasser, chair of the Islamic Development Bank, to discuss the future of Middle Eastern economic development.

HSBC Chief Executive Officer Noel Quinn, Partners Group Executive Chairman Steffen Meister and Temasek Chief Investment Officer Rohit Sipahimalani will chart a path forward for global business.

Wednesday, the chief executives of Exxon Mobil Corp. and TotalEnergies SE debate the future of hydrocarbons with Qatar's minister of state for energy affairs, and retired US Army General David Petraeus weighs in on geopolitical risks.

And Thursday, the man who brought football's World Cup to Qatar in 2022, Hassan Al Thawadi, secretary-general of the Committee for Delivery and Legacy, shares his vision for sports, media and entertainment in the Arab world.

The Best of Bloomberg Economics

Robust early-year wage growth will do little to calm nerves of European Central Bank officials pondering how much they can lower rates.

Japan's finance minister stressed the importance of coordination with the Bank of Japan to ensure they don't hinder each other's policies.

The International Monetary Fund's staff signed off on the eighth review of Argentina's $44 billion program.

New Zealand is experiencing a record exodus of citizens as a sluggish economy reduces job opportunities.

Investor confidence in Germany's economy rose for a 10th month, reflecting optimism that growth is finally returning.

French President Emmanuel Macron outlined a bold plan to transform not just France, but all of Europe. Read the story here.

Need-to-Know Research

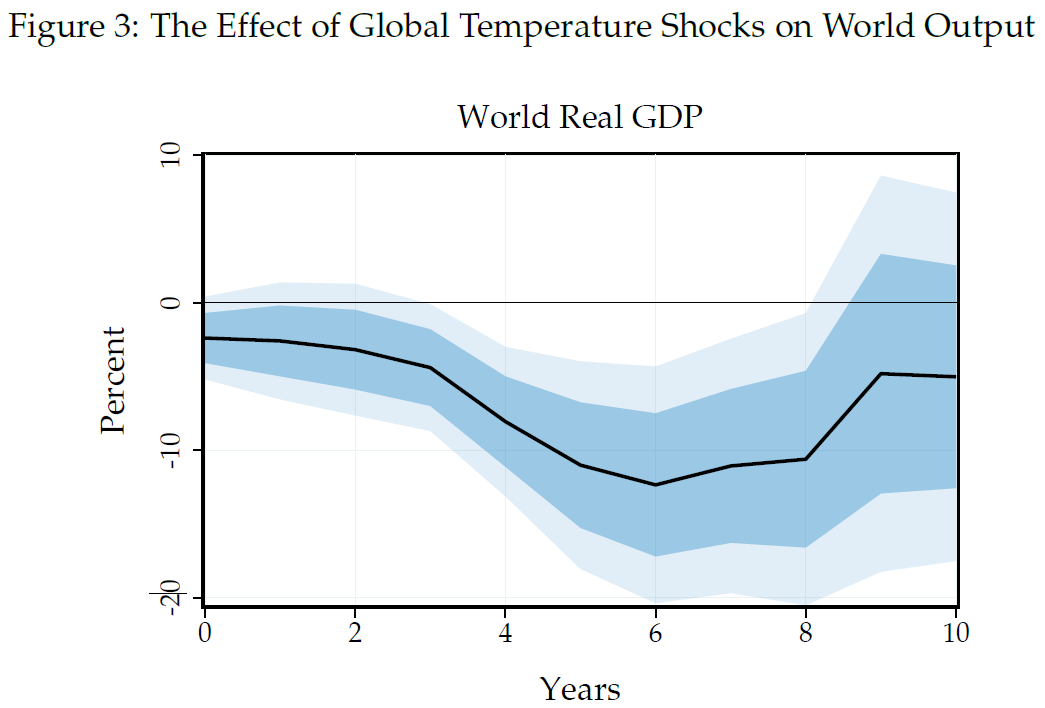

Past benchmark studies of the impact of climate change on the global economy over the longer run have underestimated the likely hit, according to a new paper published by the National Bureau of Economic Research.

Previous calculations determined that a 1-degree-Celsius temperature shock would reduce world GDP by at most 1% to 3% in the medium term. But those studies didn't do much to account for the dynamic impact of higher average temperatures. Harvard's Adrien Bilal and Northwestern's Diego Känzig now have concluded it actually leads to a 12% GDP wallop.

Source: Adrien Bilal and Diego Känzig

"This large effect is due to an associated surge in extreme climatic

events," the duo wrote. "Our results imply a social cost of carbon of

$1,056 per ton of carbon dioxide. A business-as-usual warming scenario leads to a present value welfare loss of 31%.

Now, as the world realigns on geopolitical axes, the states around the Persian Gulf are making a neutrality play of their own. Members of the Gulf Cooperation Council – Qatar, Saudi Arabia, the UAE, Kuwait, Oman and Bahrain – took pains not to confront Russia over its 2022 invasion of Ukraine. The region has also adopted a mostly independent stance on US-China relations and kept a hands-off approach to Israel's war with Hamas.

Saudi Arabia has received billions of dollars in investment from China's Belt and Road infrastructure program and envisions collaboration with Chinese companies to establish the county as a key hub for the electric-vehicle supply chain. Chinese executives last year even said they stood ready to "de-Americanize" the world's top oil exporter.

Chinese President Xi Jinping, center, at the royal palace in Riyadh, Saudi Arabia, on December 8, 2022. Photographer: Yue Yuewei/Xinhua News Agency

The neighboring United Arab Emirates has not only tightened economic ties with China but also worked with Beijing on a platform to expand the reach of the digital Chinese yuan.

As for the other key US rival, Russia, the Saudis continue to collaborate with Moscow on managing oil prices through the OPEC+ cartel. And when sanctions forced them out of Europe, Russian elites took refuge in Dubai. Even while Qatar helped Europe bear the burden of halting most Russian natural-gas imports, it also has long-term supply agreements with China.

At the same time, the Gulf countries have maintained intimate ties with Washington. For example, there's been no serious move to rethink their exchange-rate pegs to the dollar, with all the credibility that provides in the global financial system. When G42, an Abu Dhabi-based advanced-tech conglomerate with big AI plans, sought an overseas partner, it went with the US, not China.

And the region still relies on an American security umbrella — Bloomberg reported this month that Saudi Arabia and the US are even working on a historic pact that would include granting Riyadh access to advanced US weapons that were previously off-limits.

Signage at the Qatar Economic Forum (QEF) in Doha, Qatar, on May 23, 2023. The fourth annual QEF kicks off on Tuesday. Photographer: Christopher Pike/Bloomberg

Behind all the fence-sitting: a shared goal to transform the Gulf beyond its fossil fuel dependency into a trade, finance, technology and media powerhouse. That strategy – not to mention Qatar's convening power–will again be on display at the fourth annual QEF.

On Tuesday, shortly after Prime Minister Sheikh Mohammed bin Abdulrahman Al-Thani of Qatar opens the conference, the finance minister of Saudi Arabia, Mohammed Al-Jadaan, joins his Qatari counterpart, Ali Al-Kuwari, and Muhammad Al Jasser, chair of the Islamic Development Bank, to discuss the future of Middle Eastern economic development.

HSBC Chief Executive Officer Noel Quinn, Partners Group Executive Chairman Steffen Meister and Temasek Chief Investment Officer Rohit Sipahimalani will chart a path forward for global business.

Wednesday, the chief executives of Exxon Mobil Corp. and TotalEnergies SE debate the future of hydrocarbons with Qatar's minister of state for energy affairs, and retired US Army General David Petraeus weighs in on geopolitical risks.

And Thursday, the man who brought football's World Cup to Qatar in 2022, Hassan Al Thawadi, secretary-general of the Committee for Delivery and Legacy, shares his vision for sports, media and entertainment in the Arab world.

The Best of Bloomberg Economics

Robust early-year wage growth will do little to calm nerves of European Central Bank officials pondering how much they can lower rates.

Japan's finance minister stressed the importance of coordination with the Bank of Japan to ensure they don't hinder each other's policies.

The International Monetary Fund's staff signed off on the eighth review of Argentina's $44 billion program.

New Zealand is experiencing a record exodus of citizens as a sluggish economy reduces job opportunities.

Investor confidence in Germany's economy rose for a 10th month, reflecting optimism that growth is finally returning.

French President Emmanuel Macron outlined a bold plan to transform not just France, but all of Europe. Read the story here.

Need-to-Know Research

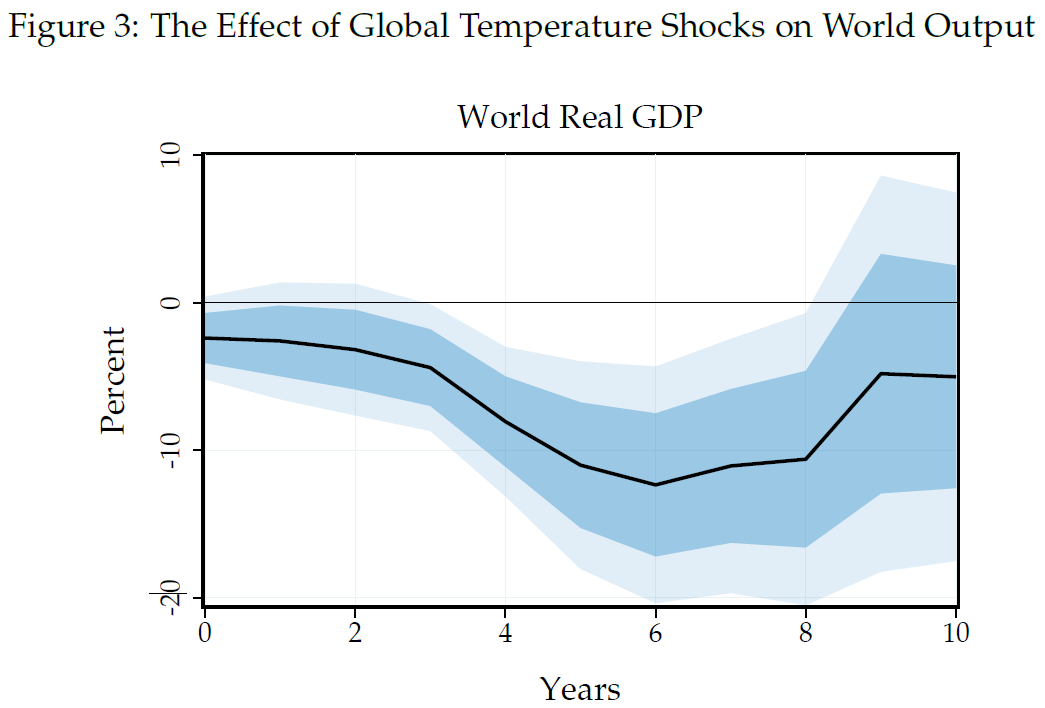

Past benchmark studies of the impact of climate change on the global economy over the longer run have underestimated the likely hit, according to a new paper published by the National Bureau of Economic Research.

Previous calculations determined that a 1-degree-Celsius temperature shock would reduce world GDP by at most 1% to 3% in the medium term. But those studies didn't do much to account for the dynamic impact of higher average temperatures. Harvard's Adrien Bilal and Northwestern's Diego Känzig now have concluded it actually leads to a 12% GDP wallop.

Source: Adrien Bilal and Diego Känzig

"This large effect is due to an associated surge in extreme climatic

events," the duo wrote. "Our results imply a social cost of carbon of

$1,056 per ton of carbon dioxide. A business-as-usual warming scenario leads to a present value welfare loss of 31%.

No comments