A section of a newly designed Japanese 1,000 yen banknote is displayed at a Japan

Since Japan relies on overseas markets for food and energy, and a large portion of its transactions are denominated in dollars, a weaker yen could raise prices of imported goods," Finance Minister Shunichi Suzuki said in Japan's parliament last week.

And Japan's central bank chief is now weighing in with increased concern. After a sit-down with Prime Minister Fumio Kishida, Bank of Japan Governor Kazuo Ueda said that "abrupt and one-sided weak yen moves" are negative for the economy, and that it's natural for the central bank to consider taking action if currency fluctuations affect the inflation outlook.

The latest BOJ signals prompted Bank of America last week to bring forward its forecast for the next interest-rate hike in Japan to July.

But despite Tokyo's broad airing of concern, the yen closed lower last week. Many observers dismiss the potential for officials to affect exchange rates — when Tokyo appeared to have stepped in to buy yen again two weeks ago, a common narrative was that such moves cannot have a lasting impact. The currency market is simply too big.

A section of a newly designed Japanese 1,000 yen banknote is displayed at a Japan Finance Ministry office in Tokyo, April 9, 2019. Photographer: Toru Hanai/Bloomberg

History suggests, however, that when a broad consensus has determined exchange rates have moved too far, it does serve as a turning point.

Bob Savage, head of markets strategy and insights at BNY Mellon in New York, points out that the yen is "not stretched just for Japan, but for the region — so this is a regional problem now for Indonesia, for Thailand, for Malaysia, definitely for China, definitely for Korea."

Coming Soon

The Best of Bloomberg Economics

Stubborn inflation is posing a risk to bullish US growth forecasts.

Unexplained outflows of capital from Turkey surged again during a month when voters went to the polls.

President Joe Biden will quadruple tariffs on Chinese electric vehicles and sharply increase levies for other key industries this week.

Australia's Treasury sees inflation returning to target, and its budget will feature a bigger boost for the nation's critical minerals industry.

British economists worried about the accuracy of official labor market data have a new concern: doubts about the number of unfilled jobs.

A warning light for Italy just flashed for Premier Giorgia Meloni after a debt sale took place to consumers who are losing enthusiasm for bonds.

The Week Ahead

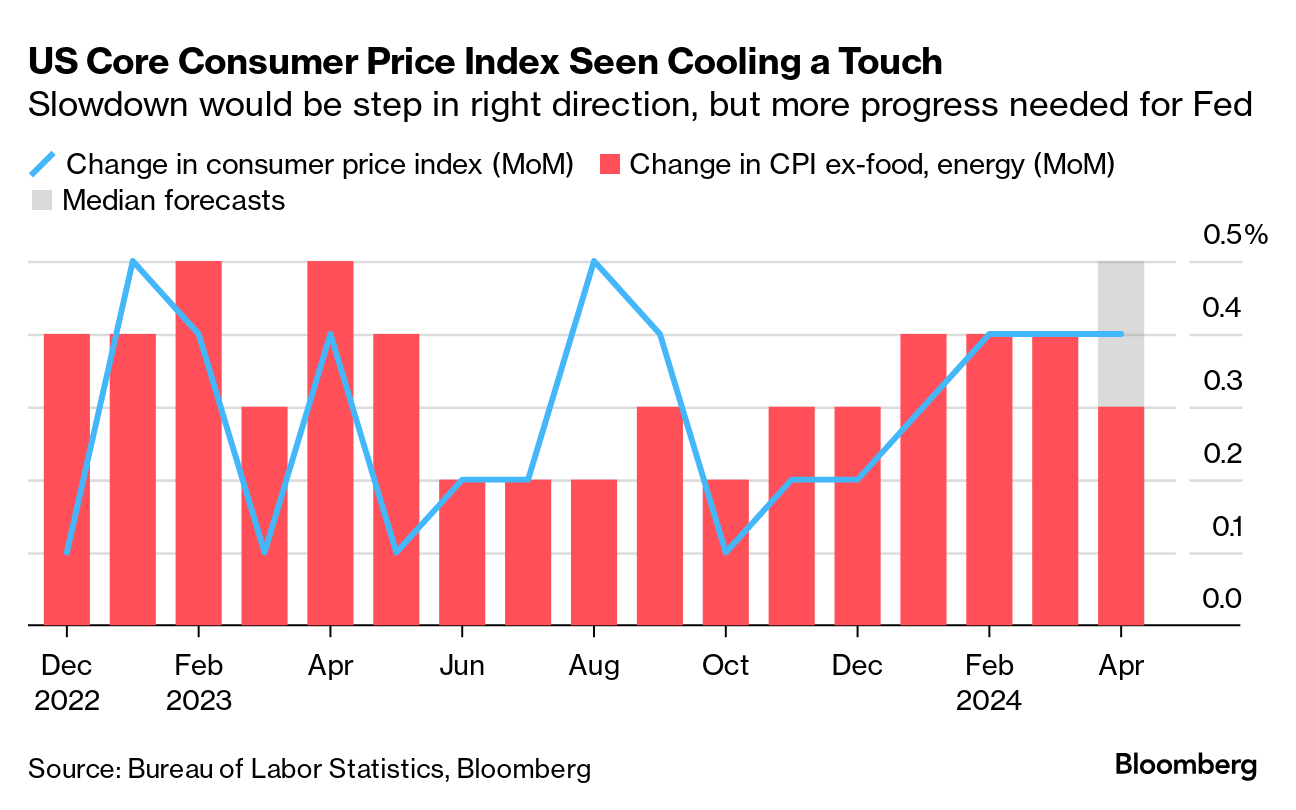

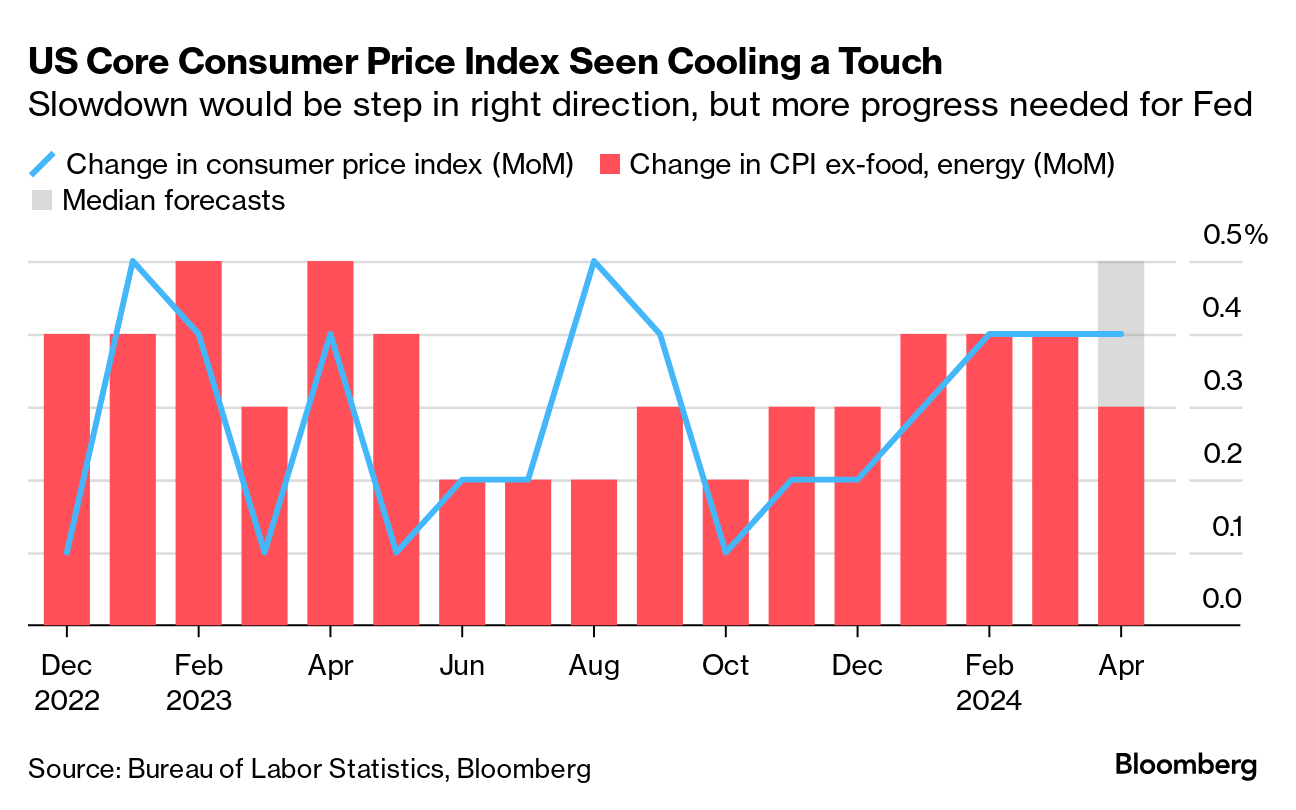

Underlying US inflation probably moderated in April for the first time in six months, offering a ray of hope that price pressures will start to ease again after a string of upside surprises.

The core consumer price index, which excludes food and fuel, is seen rising 0.3% from a month earlier after 0.4% advances throughout the first quarter. The Bureau of Labor Statistics will issue its CPI report on Wednesday.

See here for the rest of the week's economic events.

Need-to-Know Research

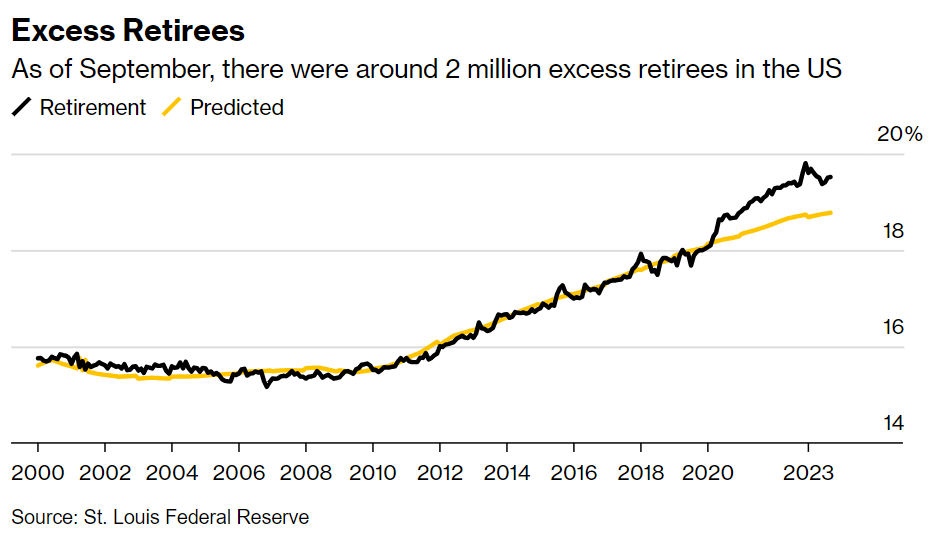

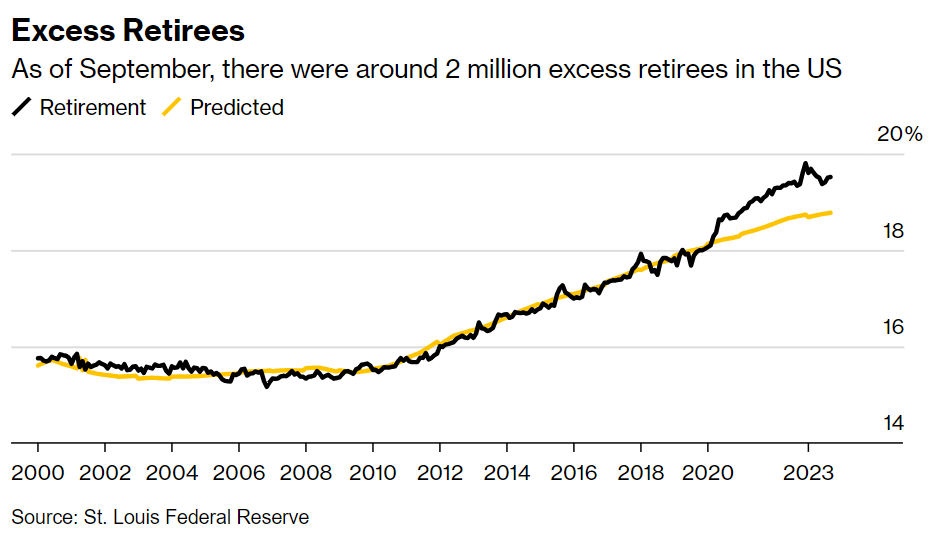

The bump to US employment from immigration has effectively bypassed concerns about payrolls being eroded by an unusually large wave of early retirements. But the so-called Great Retirement is still a thing.

That's what's suggested by new research by the Federal Reserve Bank of New York. An examination of labor market and consumer expectations surveys shows the share of people who say they will likely be working full-time after age 62 dropped to 45.8% in March. That's the smallest share in data back to 2014.

"Pandemic-induced change in retirement expectations may continue to affect the labor market in years to come," the report's authors said. There has been a cultural shift characterized by rethinking the value of work, particularly among women, according to the Fed.

And Japan's central bank chief is now weighing in with increased concern. After a sit-down with Prime Minister Fumio Kishida, Bank of Japan Governor Kazuo Ueda said that "abrupt and one-sided weak yen moves" are negative for the economy, and that it's natural for the central bank to consider taking action if currency fluctuations affect the inflation outlook.

The latest BOJ signals prompted Bank of America last week to bring forward its forecast for the next interest-rate hike in Japan to July.

But despite Tokyo's broad airing of concern, the yen closed lower last week. Many observers dismiss the potential for officials to affect exchange rates — when Tokyo appeared to have stepped in to buy yen again two weeks ago, a common narrative was that such moves cannot have a lasting impact. The currency market is simply too big.

A section of a newly designed Japanese 1,000 yen banknote is displayed at a Japan Finance Ministry office in Tokyo, April 9, 2019. Photographer: Toru Hanai/Bloomberg

History suggests, however, that when a broad consensus has determined exchange rates have moved too far, it does serve as a turning point.

Bob Savage, head of markets strategy and insights at BNY Mellon in New York, points out that the yen is "not stretched just for Japan, but for the region — so this is a regional problem now for Indonesia, for Thailand, for Malaysia, definitely for China, definitely for Korea."

Coming Soon

The Best of Bloomberg Economics

Stubborn inflation is posing a risk to bullish US growth forecasts.

Unexplained outflows of capital from Turkey surged again during a month when voters went to the polls.

President Joe Biden will quadruple tariffs on Chinese electric vehicles and sharply increase levies for other key industries this week.

Australia's Treasury sees inflation returning to target, and its budget will feature a bigger boost for the nation's critical minerals industry.

British economists worried about the accuracy of official labor market data have a new concern: doubts about the number of unfilled jobs.

A warning light for Italy just flashed for Premier Giorgia Meloni after a debt sale took place to consumers who are losing enthusiasm for bonds.

The Week Ahead

Underlying US inflation probably moderated in April for the first time in six months, offering a ray of hope that price pressures will start to ease again after a string of upside surprises.

The core consumer price index, which excludes food and fuel, is seen rising 0.3% from a month earlier after 0.4% advances throughout the first quarter. The Bureau of Labor Statistics will issue its CPI report on Wednesday.

See here for the rest of the week's economic events.

Need-to-Know Research

The bump to US employment from immigration has effectively bypassed concerns about payrolls being eroded by an unusually large wave of early retirements. But the so-called Great Retirement is still a thing.

That's what's suggested by new research by the Federal Reserve Bank of New York. An examination of labor market and consumer expectations surveys shows the share of people who say they will likely be working full-time after age 62 dropped to 45.8% in March. That's the smallest share in data back to 2014.

"Pandemic-induced change in retirement expectations may continue to affect the labor market in years to come," the report's authors said. There has been a cultural shift characterized by rethinking the value of work, particularly among women, according to the Fed.

No comments