Biden stumbles

I really don't know what he said at the end of that sentence, and I don't think he knows what he said either," Trump said in response to one of Biden's answers about the US-Mexico border.

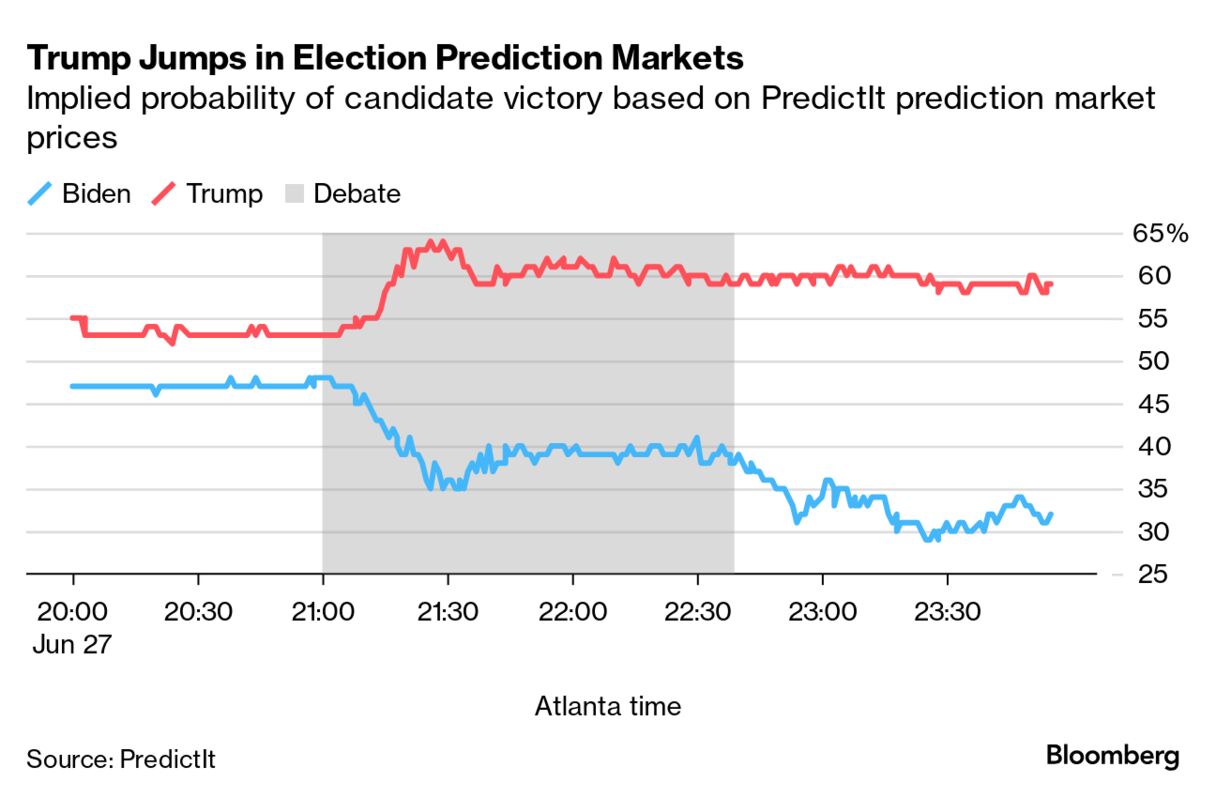

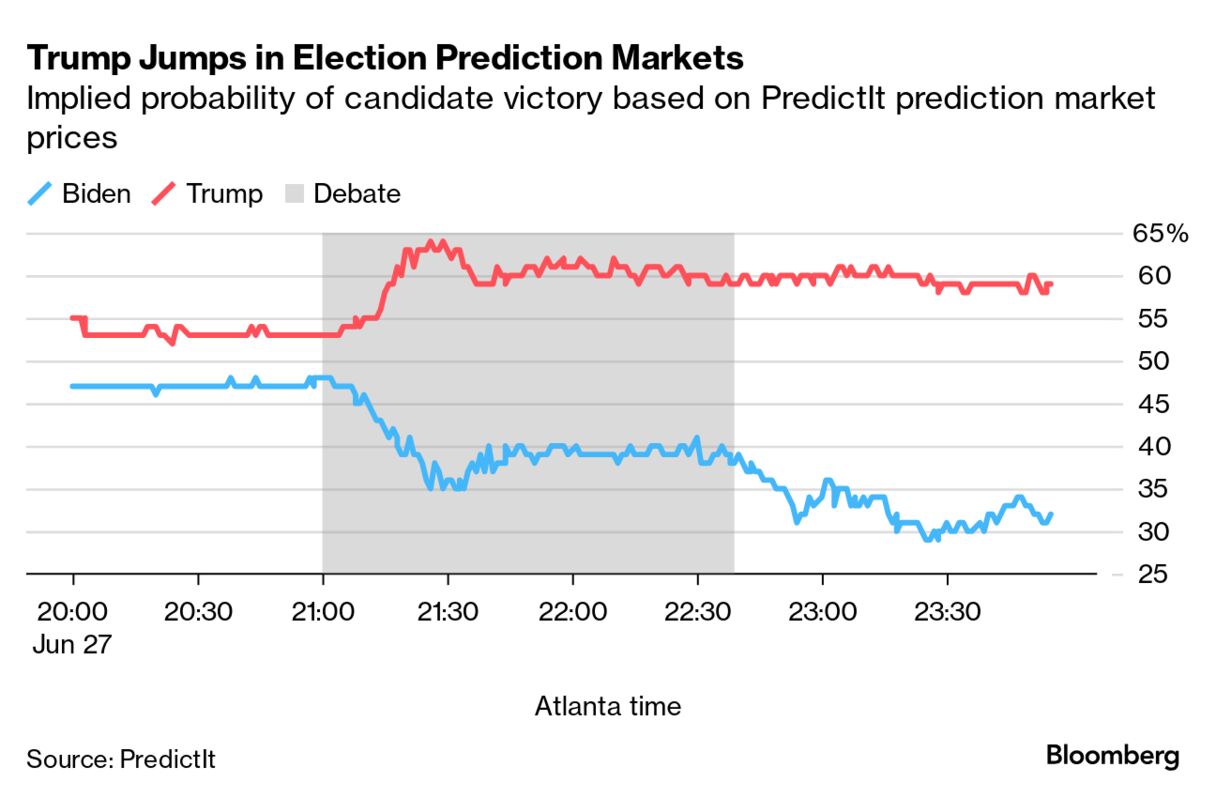

The dollar and Bitcoin rose as the debate got going, while PredictIt's live betting odds swung sharply in Trump's favor. A Chinese meme stock whose local-language name sounds like "Trump wins big" jumped by its daily limit in Shenzhen.

Bloomberg's gauge of the dollar held near an eight-month high, on track for a sixth straight weekly gain.

"Trump's policies are likely to add to inflationary pressures and escalate trade tensions, thereby supporting US interest rates and the safe-haven US dollar," said Carol Kong, a strategist at Commonwealth Bank of Australia in Sydney.

Nobel Criticism

Trump has floated ideas including a 10% tax on all US imports and far steeper levies on Chinese-made goods. While some economists — including 16 Nobel prize winners in a recent open letter — have warned that'll add to inflation risks, most market analysts have yet to bake such policies into their forecasts. They may have to crank up those spreadsheets.

Nearer term data, such as the Federal Reserve's preferred inflation gauge due Friday, will be key to those rates bets. Economists expect no change in the May personal consumption expenditures price index and a minimal 0.1% gain in the core measure that excludes food and energy.

The Best of Bloomberg Economics

The European Central Bank can look through one-off fluctuations in euro-area inflation statistics, according to Governing Council member Francois Villeroy de Galhau. Meanwhile, French inflation slowed a little.

Chinese leader Xi Jinping called for the Global South to have a greater say in international affairs.

Argentina's Congress approved President Javier Milei's signature pro-business reforms, marking an inflection point for the outsider to govern with a hostile political class he continues to rail against.

Japan is getting a new currency czar just as the yen trades near its weakest levels in almost four decades, the nation's finance minister said.

India is set to lure billions of dollars more inflows when JPMorgan adds the nation's government bonds to its emerging markets index.

The IMF said the US is running deficits that are too big and is weighed down by too much debt.

The peso's volatility influenced the central bank's decision Thursday to hold rates steady, Banco de Mexico's Governor Victoria Rodriguez said.

Need-to-Know Research

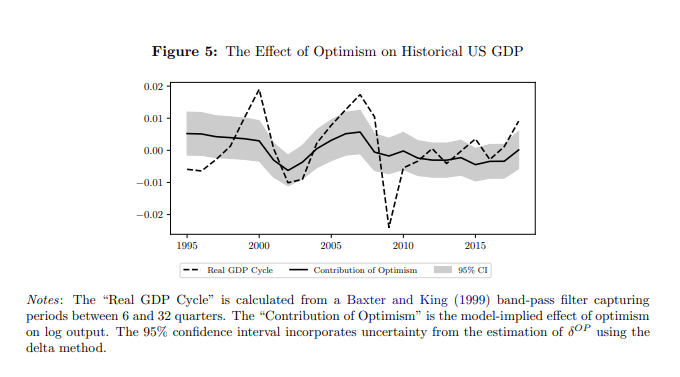

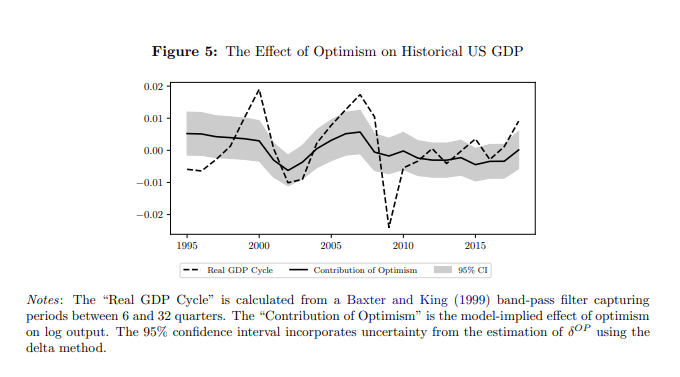

Economic narratives play a role in stoking boom and bust cycles, impacting firms' decisions on when to invest or cut back.

New research titled The Macroeconomics of Narratives found that "firms expand after adopting optimistic narratives, even though these narratives have no predictive power for future firm fundamentals."

Such narratives can explain 32% and 18% of output reductions over the early 2000s recession and Great Recession, respectively, and 19% of output variance.

The dollar and Bitcoin rose as the debate got going, while PredictIt's live betting odds swung sharply in Trump's favor. A Chinese meme stock whose local-language name sounds like "Trump wins big" jumped by its daily limit in Shenzhen.

Bloomberg's gauge of the dollar held near an eight-month high, on track for a sixth straight weekly gain.

"Trump's policies are likely to add to inflationary pressures and escalate trade tensions, thereby supporting US interest rates and the safe-haven US dollar," said Carol Kong, a strategist at Commonwealth Bank of Australia in Sydney.

Nobel Criticism

Trump has floated ideas including a 10% tax on all US imports and far steeper levies on Chinese-made goods. While some economists — including 16 Nobel prize winners in a recent open letter — have warned that'll add to inflation risks, most market analysts have yet to bake such policies into their forecasts. They may have to crank up those spreadsheets.

Nearer term data, such as the Federal Reserve's preferred inflation gauge due Friday, will be key to those rates bets. Economists expect no change in the May personal consumption expenditures price index and a minimal 0.1% gain in the core measure that excludes food and energy.

The Best of Bloomberg Economics

The European Central Bank can look through one-off fluctuations in euro-area inflation statistics, according to Governing Council member Francois Villeroy de Galhau. Meanwhile, French inflation slowed a little.

Chinese leader Xi Jinping called for the Global South to have a greater say in international affairs.

Argentina's Congress approved President Javier Milei's signature pro-business reforms, marking an inflection point for the outsider to govern with a hostile political class he continues to rail against.

Japan is getting a new currency czar just as the yen trades near its weakest levels in almost four decades, the nation's finance minister said.

India is set to lure billions of dollars more inflows when JPMorgan adds the nation's government bonds to its emerging markets index.

The IMF said the US is running deficits that are too big and is weighed down by too much debt.

The peso's volatility influenced the central bank's decision Thursday to hold rates steady, Banco de Mexico's Governor Victoria Rodriguez said.

Need-to-Know Research

Economic narratives play a role in stoking boom and bust cycles, impacting firms' decisions on when to invest or cut back.

New research titled The Macroeconomics of Narratives found that "firms expand after adopting optimistic narratives, even though these narratives have no predictive power for future firm fundamentals."

Such narratives can explain 32% and 18% of output reductions over the early 2000s recession and Great Recession, respectively, and 19% of output variance.

No comments