Slowing inflation is expected to offer the Federal Reserve a window to finally deliver its first rate cut in the months ahead. What's less clear is how many reductions are in the offing. While Fed officials pencil in just one quarter percentage point move this year and forecast four in 2025, a look at recent cycles shows it has never delivered that quantum of easing unless triggered by a crisis. Working backwards, it was the Covid-19 pandemic, 2007-08 financial crisis, Dot-com bubble and September 11 terror attacks, and the post-Gulf War recession that prompted the most notable easing cycles in the modern rates era. Other moves, in 2019, 2002-03, 1998 and 1995-96, were more limited "mid-cycle" adjustments totaling 75 basis points each time. While it's impossible to predict the future, risks at home and abroad could flare to force Fed Chair Jerome Powell to take bolder easing steps. Tech Bubble 2.0

The sage of Omaha, Warren Buffett, has a rule of thumb that when the total value of US equities nears 200% of gross domestic product, stocks could be set for a reversal. That indicator is currently at 189%, driven by an eye-popping rally in AI darling Nvidia Corp.

This week's volatility in tech highlights the risk of a correction. If a sell off spirals, consumer confidence would take a beating, financial conditions tighten and losses spread to unpredictable parts of the financial system. Europe Wobbles

French President Emmanuel Macron's call for a snap vote for parliament has focused investors on the potential for a big-spending populist government taking office.

Analysts at Evercore recently cautioned that the political uncertainty in France "threatens a prolonged phase of dysfunctionality in Europe and in the tail could threaten a new euro crisis." War RisksAny further escalation in Middle East tensions has dual risks for the Fed. If, for instance, fighting between Israel and Hezbollah were to morph into all-out war, oil prices could spike resulting in stagflation risks at a time of slowing economic growth. US Defense Secretary Lloyd Austin says a war between Israel and the Lebanese militant group Hezbollah would have "terrible consequences." Then there's the potential for Russia's war in Ukraine to further upend supply chains and confidence. "Russia's war of aggression against Ukraine and the critical situation in the Middle East could further disrupt international trade flows, the smooth functioning of supply chains, and living conditions," Group of Seven finance ministers and central bankers warned last month in Stresa, Italy. Commercial PropertyFed Bank of Minneapolis President Neel Kashkari last month pointed to stress within the commercial property market, saying he expects "big losses" and surprises in where the losses take place. As the Fed found out back in 2007-08, red ink in one part of the real estate sector can quickly spread. Messy ElectionPresident Joe Biden and his predecessor and rival Donald Trump will face off for the first debate of the general election later Thursday. That'll sharpen investors minds on what's likely to be one of the most acrimonious campaigns in history. A messy election, or more-worryingly a messy outcome, could rattle markets and consumers. Economists at Goldman Sachs say there's already "early signs of an increase in election-related uncertainty that could weigh on business investment," economist Jan Hatzius wrote in a recent note to clients. Trade WarsIf Trump does prove victorious and follows through with threats to introduce hefty across-the-board tariffs, including on goods from China, household budgets and American businesses could take a hit. Former Treasury Secretary Lawrence Summers called it "a prescription for the mother of all stagflations," referring to a scenario of high inflation combined with low economic growth. For economists, such black swan scenarios are almost impossible to build into interest-rate forecasts. But as recent history shows, it's burst bubbles, wars and pestilence that have sparked the most notable easing moves. - China industrial profits rose modestly with commodity prices.

- More than 1.5 million UK households could see their mortgage payments fall by the end of this year, the Bank of England said.

- South Korea plans to launch a 5 trillion won ($3.6 billion) fund to reduce its dependence on foreign supplies.

- Global trade tariffs were top of mind for attendees at the event known as Summer Davos in China this week.

- Indonesia's Tourism Minister Sandiaga Uno is on a mission to get Chinese tourists to look beyond Bali for their next tropical getaway.

- Kenya's president bowed to protests and withdrew a raft of tax hikes — now he must fix the budget.

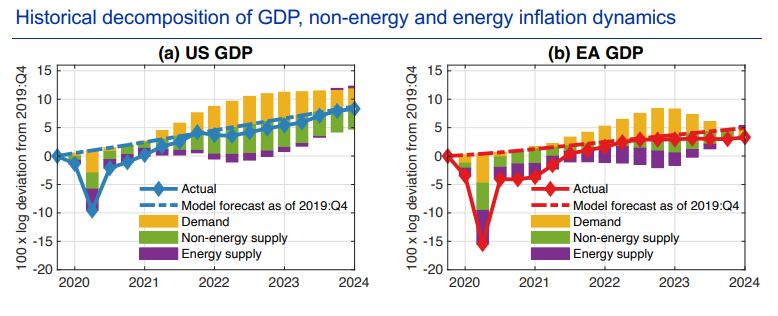

Post-Covid inflation was predominantly driven by unexpectedly strong demand forces, not only in the US, but also in the euro area, according to a paper that will be presented at the European Central Bank's annual forum in Sintra next week. "In comparison, the inflationary impact of adverse supply shocks was less pronounced, even though these shocks significantly constrained economic activity," researchers Domenico Giannone and Giorgio Primiceri said.  Source: ECB "With output already weakened by these unfavorable supply conditions, any attempt by the ECB to further mitigate the demand-driven inflationary pressures — to maintain inflation near its 2% target — would have severely hampered an already anaemic recovery," they wrote. Other papers that will feature at the ECB's showcase event are on the economics of biodiversity loss, on European productivity and on rates cycles. |

No comments