Bumpy rate ride

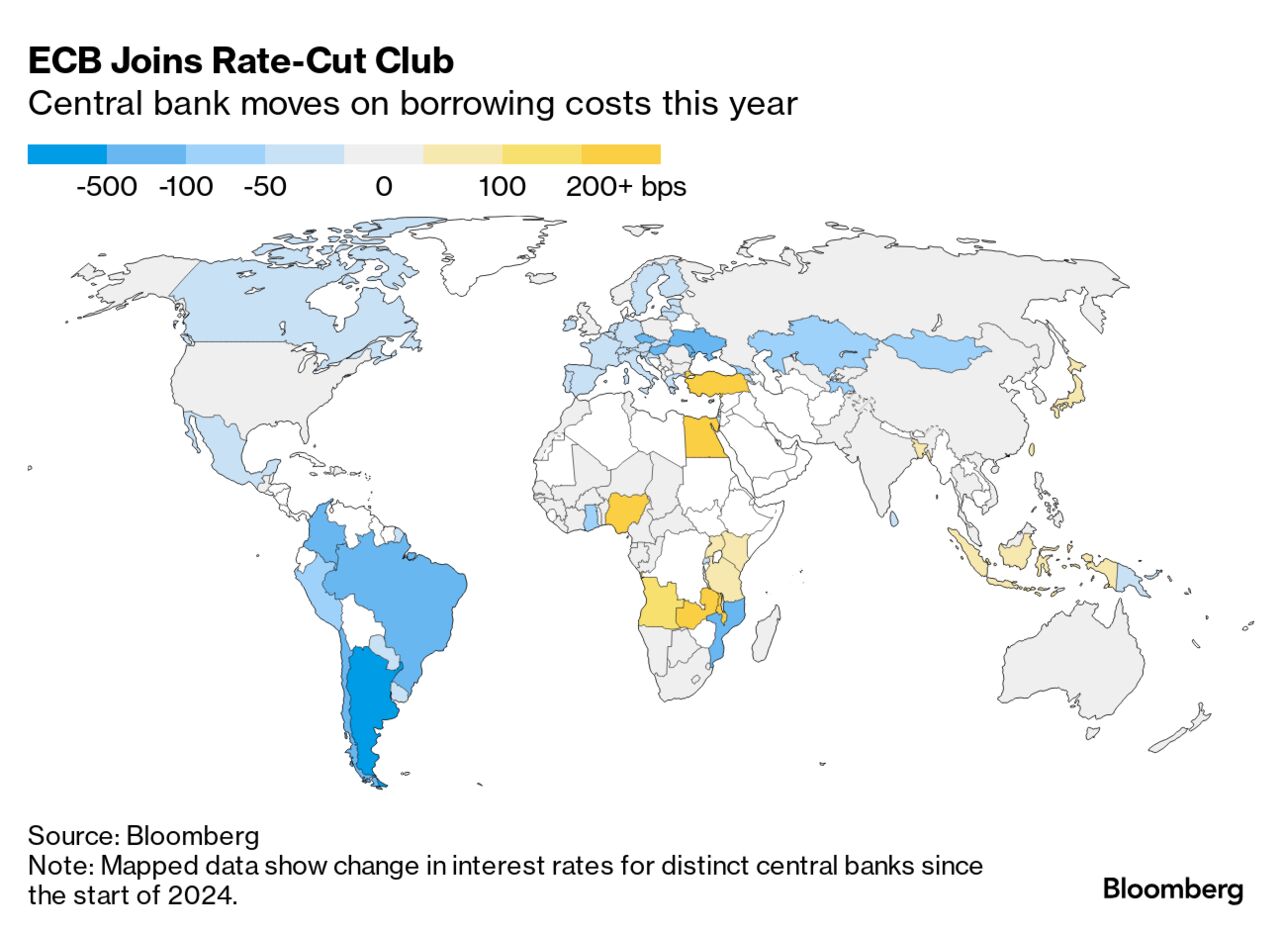

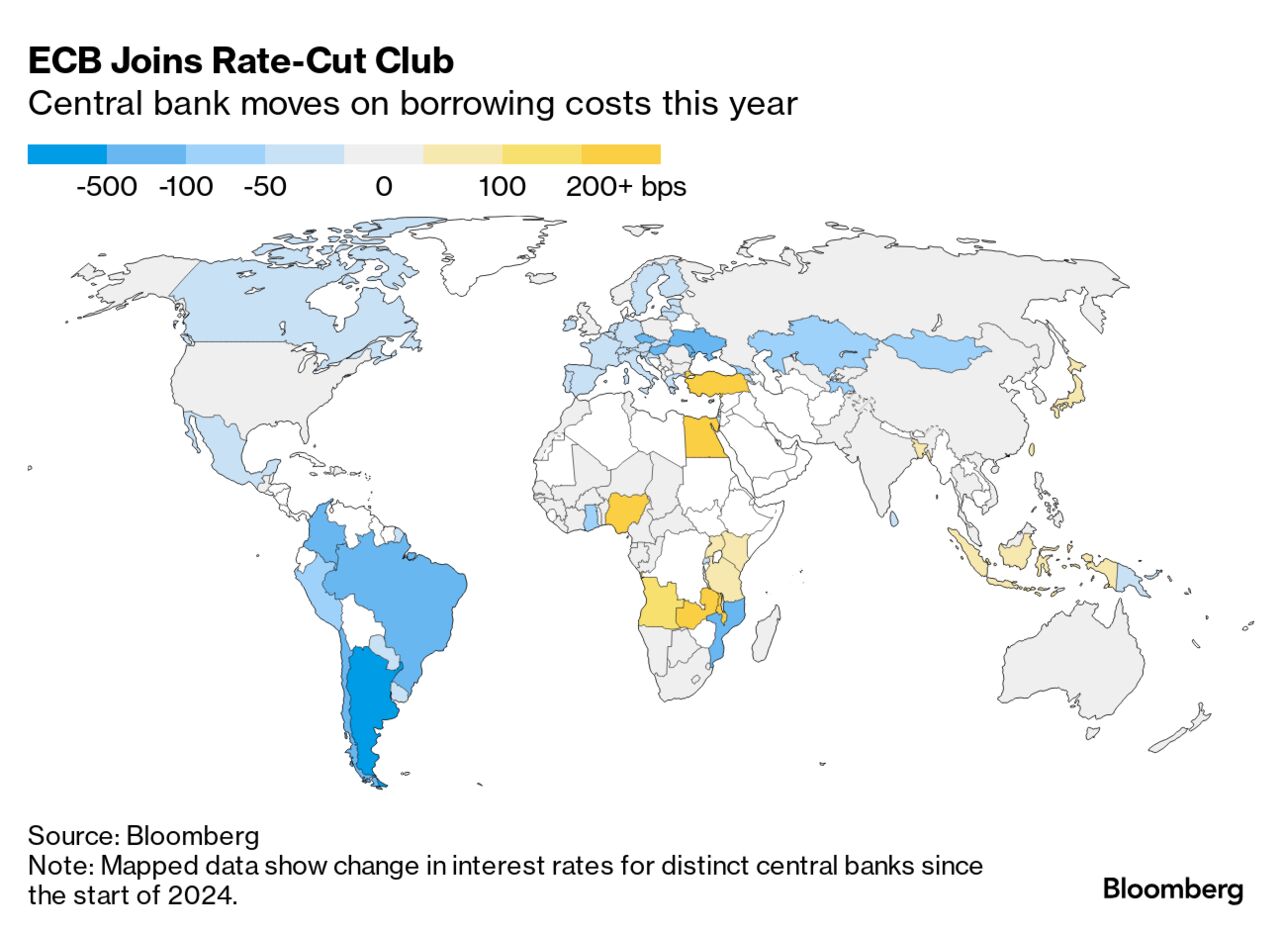

After the steepest interest-rate tightening cycle in decades and a long holding cycle, how fast to unwind such settings is now a dominant theme.

The Bank of Canada and European Central Bank both cut rates by 25 basis points in the Group of Seven's first easing moves since the pandemic. They joined officials in Switzerland and Sweden who moved earlier this year.

But that's about where the synchronization ends. Messages on inflation varied: In Canada on Wednesday, Governor Tiff Macklem struck a dovish tone, with economists expecting several more cuts this year.

But yesterday in Frankfurt, the signal was less assured as ECB President Christine Lagarde said that policymakers aren't necessarily shifting to a "dialing-back phase." Their rate cut was accompanied by projections showing that it will now take longer to get inflation back to the 2% goal.

The policy divergence is playing out elsewhere too. It's not clear if the Swiss National Bank will follow up its reduction in March with another move this month. The Bank of England meanwhile looks unlikely to begin an easing cycle this month as it gauges the strength of inflation.

Elsewhere, the Federal Reserve is still firmly on a higher-for-longer path, Australia's central bank is deep in the fight against inflation. Across Asia, some peers are even raising borrowing costs to protect their currencies.

That divergence is a very different dynamic from the immediate post-pandemic period, when central banks globally united for one singular challenge: taming surging inflation. Since then, domestic issues and local growth drivers have taken the front seat and policymakers are feeling more comfortable moving ahead of the US.

Inflation has also proved stickier in some countries, and a resurgent menace in others. In the euro zone, for example, consumer-price growth quickened more than expected last month, while a measure of wage pressures released on Friday showed acceleration.

"More than a dozen central banks have cut rates already and there's been a lot of decoupling from the Fed," Robert Subbaraman, head of global markets research at Nomura, said yesterday. "It might be more bumpy from here."

The Bank of Canada and European Central Bank both cut rates by 25 basis points in the Group of Seven's first easing moves since the pandemic. They joined officials in Switzerland and Sweden who moved earlier this year.

But that's about where the synchronization ends. Messages on inflation varied: In Canada on Wednesday, Governor Tiff Macklem struck a dovish tone, with economists expecting several more cuts this year.

But yesterday in Frankfurt, the signal was less assured as ECB President Christine Lagarde said that policymakers aren't necessarily shifting to a "dialing-back phase." Their rate cut was accompanied by projections showing that it will now take longer to get inflation back to the 2% goal.

The policy divergence is playing out elsewhere too. It's not clear if the Swiss National Bank will follow up its reduction in March with another move this month. The Bank of England meanwhile looks unlikely to begin an easing cycle this month as it gauges the strength of inflation.

Elsewhere, the Federal Reserve is still firmly on a higher-for-longer path, Australia's central bank is deep in the fight against inflation. Across Asia, some peers are even raising borrowing costs to protect their currencies.

That divergence is a very different dynamic from the immediate post-pandemic period, when central banks globally united for one singular challenge: taming surging inflation. Since then, domestic issues and local growth drivers have taken the front seat and policymakers are feeling more comfortable moving ahead of the US.

Inflation has also proved stickier in some countries, and a resurgent menace in others. In the euro zone, for example, consumer-price growth quickened more than expected last month, while a measure of wage pressures released on Friday showed acceleration.

"More than a dozen central banks have cut rates already and there's been a lot of decoupling from the Fed," Robert Subbaraman, head of global markets research at Nomura, said yesterday. "It might be more bumpy from here."

No comments