Evil twins

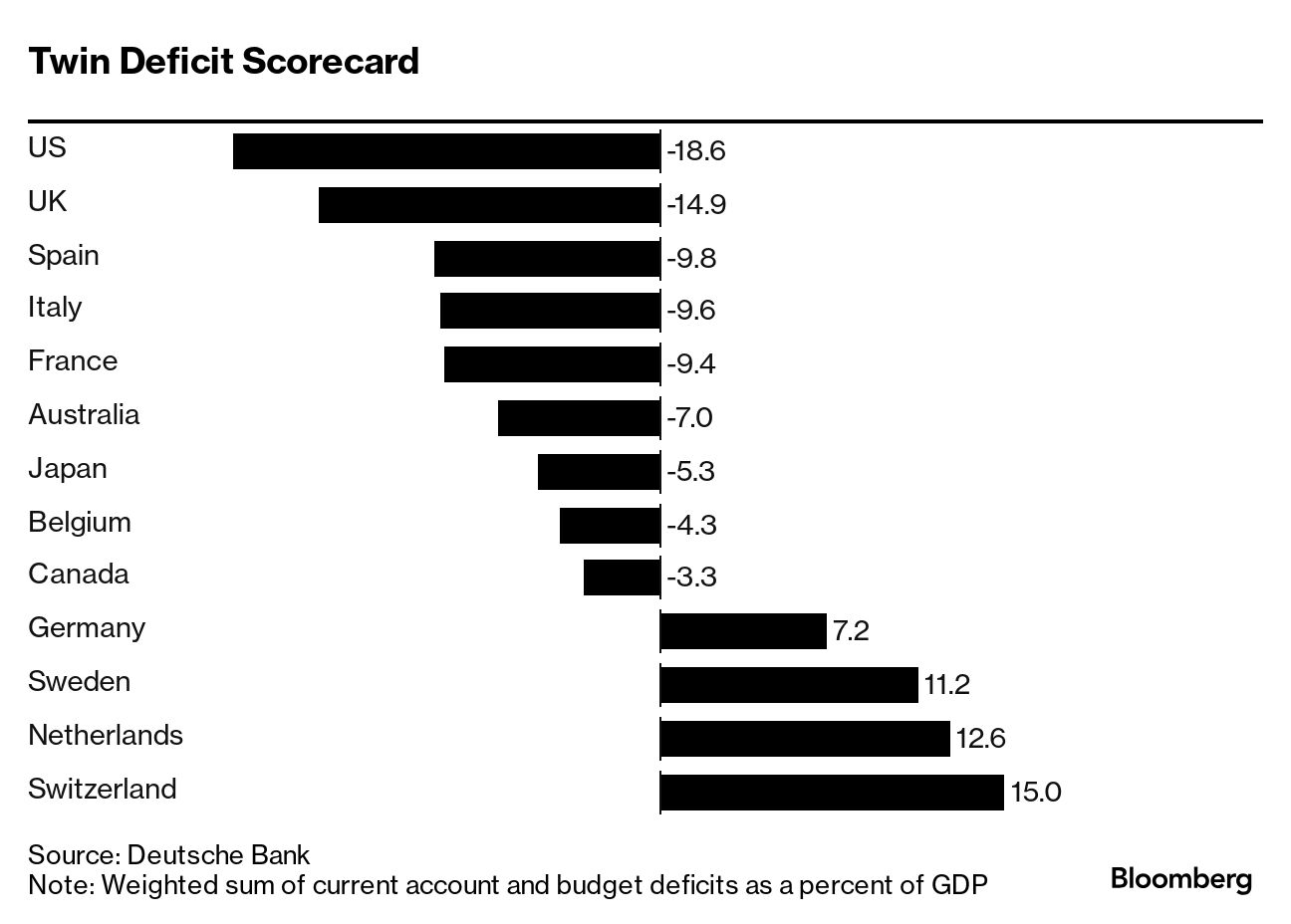

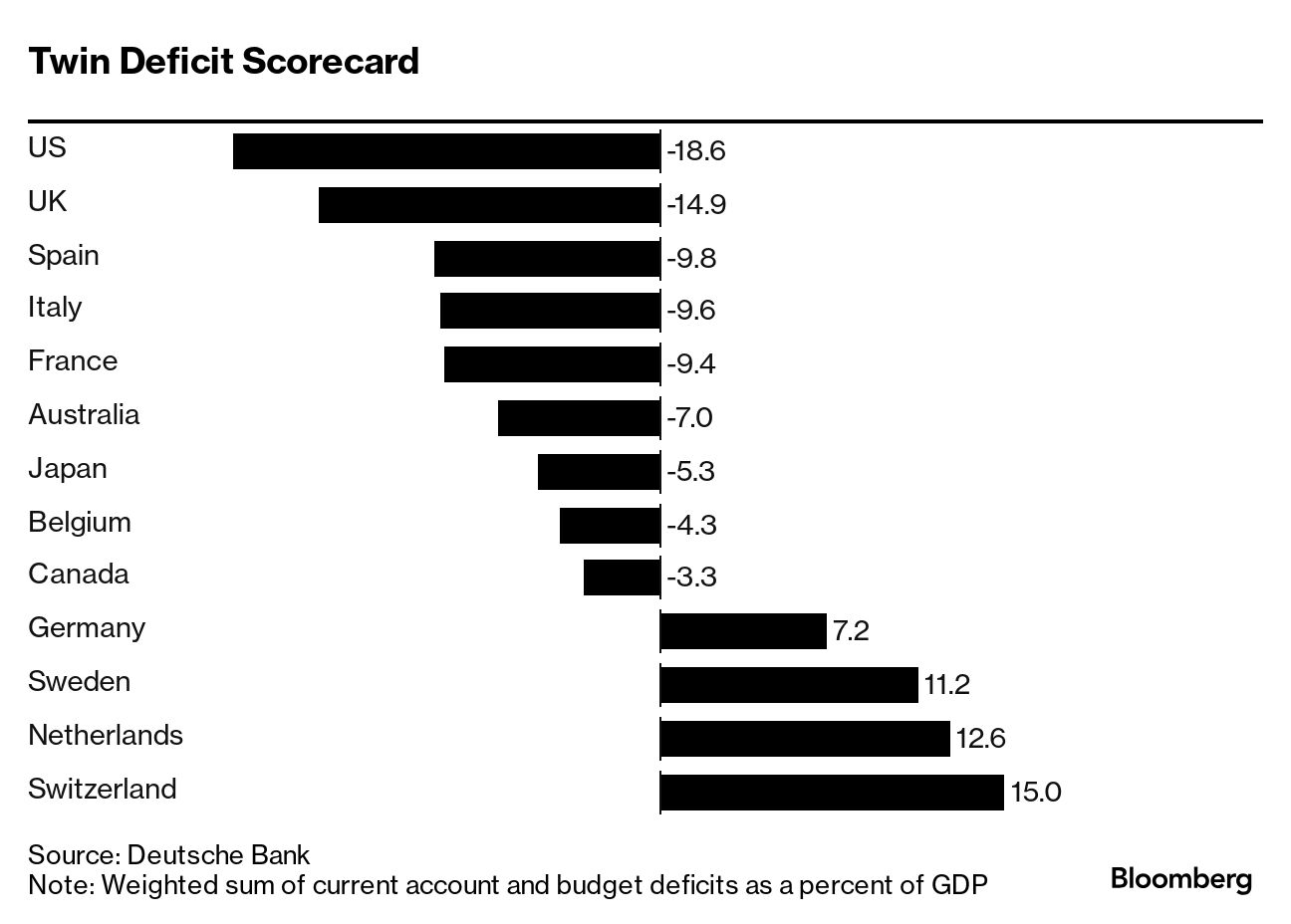

In the early 1980s, the twin deficits were a mark of opprobrium. The term referred to countries that ran both bloated budget and current account deficits. And the US was seen as culprit No. 1.

Today, the US is once again the poster child for what at one time were called the evil twins. But now they're seen more as a symbol of strength than weakness and a sign of American exceptionalism.

Sure, the mammoth US budget deficit is unsustainable in the long run for the world's largest economy. But the ability of Washington to finance it at reasonable interest rates shows how much demand there is for Treasury paper. And the yawning trade shortfall is the result of an economy that is outpacing its peers.

Other countries aren't so fortunate, according to strategists at Deutsche Bank. For nations apart from the US, the twin deficits are indicative of their vulnerability to sudden shifts in investor sentiment — and a measure of the limits they face on budget-busting government spending, so-called fiscal space.

France is in the spotlight in that regard at the moment. By Deutsche Bank's reckoning, it ranks near the top of the chart of twin deficit offenders as it has struggled to tackle the debt burden from the Covid-19 pandemic and the energy crisis triggered by Russia's invasion of Ukraine.

Investors fear things could get much worse if Marine Le Pen's National Rally party wins a majority in upcoming parliamentary elections.

The far-right party, which commands a sizable lead in opinion polls, has touted some costly budget measures, though it has wound back some of the promises in recent days to build credibility on economic matters.

Francis Yared and his fellow Deutsche Bank strategists don't see the US facing any such constraints anytime soon.

"The US should continue to benefit from a privileged position as long as there are no credible alternatives" to Treasuries as the world's safest asset, they wrote in a report last week.

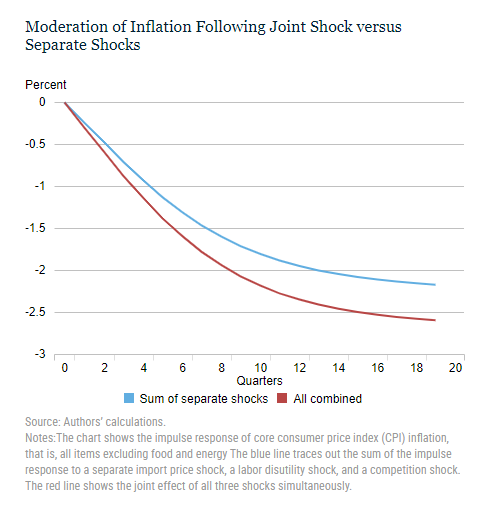

Downward pressure on inflation may diminish as supply chains returning to normal will limit disinflation, according to new research from the Federal Reserve Bank of New York.

In a paper titled Deciphering the Disinflation Process, the research found that the pandemic era shock to imports and the labor market played a role early in the inflation surge. Conversely, as that supply crunch eased it helped to slow inflation.

Now, the gradual return of those supply conditions to normal means its contribution to the disinflation process will be reduced.

Today, the US is once again the poster child for what at one time were called the evil twins. But now they're seen more as a symbol of strength than weakness and a sign of American exceptionalism.

Sure, the mammoth US budget deficit is unsustainable in the long run for the world's largest economy. But the ability of Washington to finance it at reasonable interest rates shows how much demand there is for Treasury paper. And the yawning trade shortfall is the result of an economy that is outpacing its peers.

Other countries aren't so fortunate, according to strategists at Deutsche Bank. For nations apart from the US, the twin deficits are indicative of their vulnerability to sudden shifts in investor sentiment — and a measure of the limits they face on budget-busting government spending, so-called fiscal space.

France is in the spotlight in that regard at the moment. By Deutsche Bank's reckoning, it ranks near the top of the chart of twin deficit offenders as it has struggled to tackle the debt burden from the Covid-19 pandemic and the energy crisis triggered by Russia's invasion of Ukraine.

Investors fear things could get much worse if Marine Le Pen's National Rally party wins a majority in upcoming parliamentary elections.

The far-right party, which commands a sizable lead in opinion polls, has touted some costly budget measures, though it has wound back some of the promises in recent days to build credibility on economic matters.

Francis Yared and his fellow Deutsche Bank strategists don't see the US facing any such constraints anytime soon.

"The US should continue to benefit from a privileged position as long as there are no credible alternatives" to Treasuries as the world's safest asset, they wrote in a report last week.

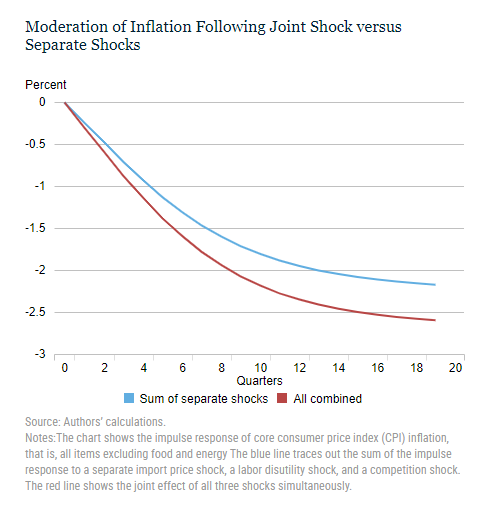

Downward pressure on inflation may diminish as supply chains returning to normal will limit disinflation, according to new research from the Federal Reserve Bank of New York.

In a paper titled Deciphering the Disinflation Process, the research found that the pandemic era shock to imports and the labor market played a role early in the inflation surge. Conversely, as that supply crunch eased it helped to slow inflation.

Now, the gradual return of those supply conditions to normal means its contribution to the disinflation process will be reduced.

No comments