Fed doubts

Perhaps the most important question facing the Federal Reserve today is just how tight its current policy setting is. That in turn would influence how quickly inflation can come down, and when policymakers can finally lower interest rates.

Fed Chair Jerome Powell has repeatedly assured that, with the benchmark rate around 5.33% — the highest in more than two decades — the current stance is restrictive and will indeed bring inflation back to 2% in time.

Others have doubts, pointing to the resilience of both the economy and the financial system. Even within the Fed there's some skepticism. Dallas Fed President Lorie Logan said May 30 that it "may be that policy is just not as restrictive as we think it might have been relative to the level of interest rates before the pandemic."

Speaking ahead of the policy communications blackout period ahead of the Fed's June 11-12 meeting, Logan urged keeping "all options on the table."

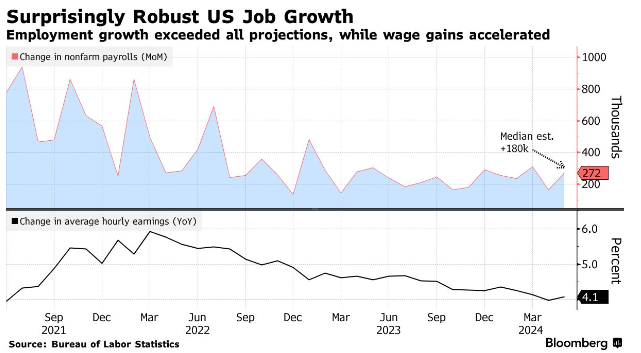

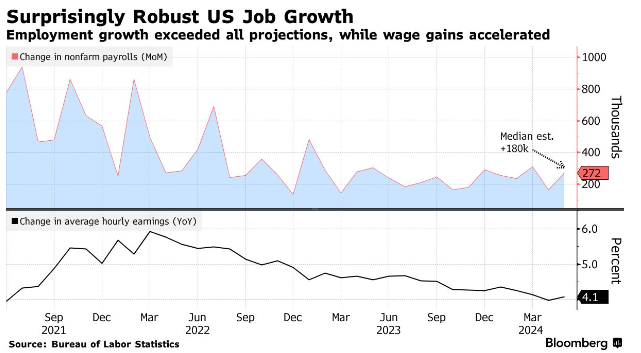

Friday's jobs report for May would surely have reinforced her doubts.

Employers added 272,000 new jobs in May, exceeding all estimates in a Bloomberg survey. On top of that, average hourly earnings over the past 12 months ticked up after three straight declines that had begun to reassure the central bank.

The figures reopened "the door a little bit wider on the debate over whether or not policy is indeed as restrictive as the Fed thinks it is," BlackRock Inc.'s Jeffrey Rosenberg said on Bloomberg Television.

Treasuries sold off and the dollar strengthened after the report. Interest-rate futures suggested diminishing confidence among traders that Powell and his colleagues will lower rates twice this year, by a cumulative 50 basis points.

Policymakers at this week's meeting will update their projections for where they see their benchmark at year-end and over the longer haul. Economists are divided on what they're likely to do with that so-called dot-plot.

A 41% plurality of economists expect the Fed to signal two cuts for this year, while an equal number expect the forecasts to show just one or no cuts at all, a Bloomberg survey shows. Back in March, the Fed was still penciling in three reductions by year-end.

The Best of Bloomberg Economics

The European Central Bank may not cut rates again for a while as it watches to see how quickly inflation recedes, Joachim Nagel said.

Brazil's central bank chief said the country's neutral structural interest rate is high and it's important to fight the cause of that.

Climate change in the UK is delivering extreme weather, creating a headache for economists trying to predict retail and growth data.

From bust to boom: Greece, Spain and Portugal were once Europe's economic basket cases — not any more.

Support for Australian Prime Minister Anthony Albanese's party is slumping after a weak growth figures.

Japan's big business lobby said current laws that effectively force married women to go by their husbands' names for present a business risk.

The Week Ahead

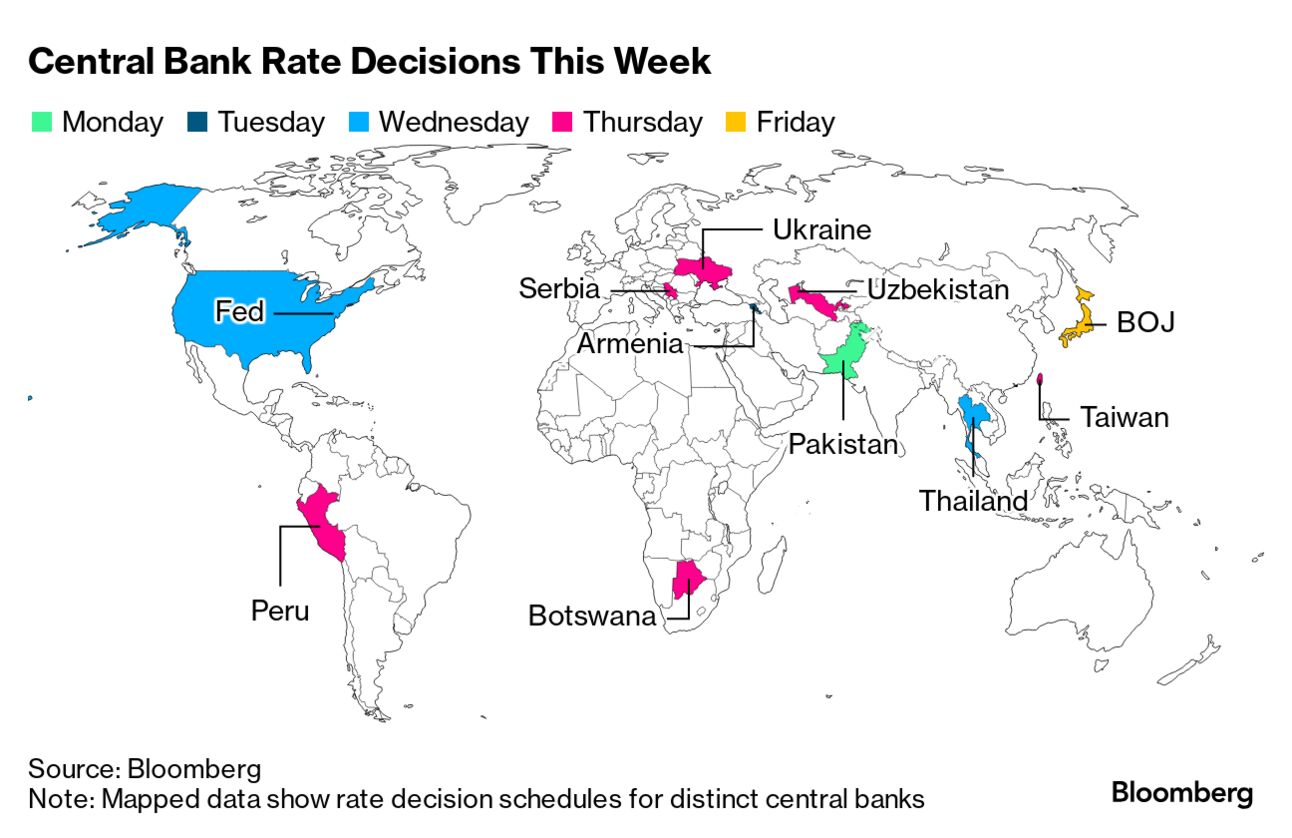

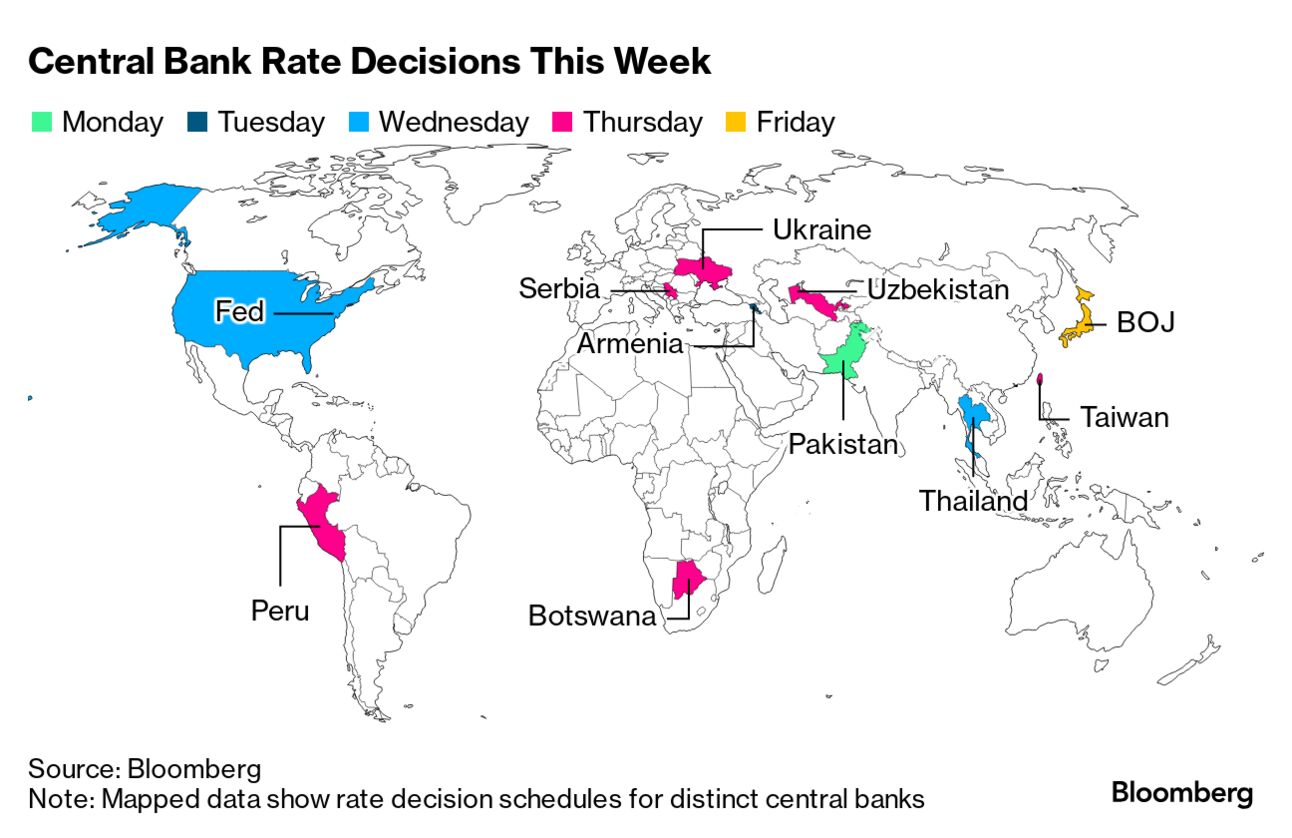

After this week's Fed decision, the Bank of Japan will grab the spotlight Friday when its board concludes a two-day meeting with a policy decision.

While the bank is expected to hold its short-term rate steady, people familiar with the matter have said officials may discuss whether to reduce bond purchases.

Source: Bloomberg

Inflation figures due from China to Sweden will also draw the attention of traders. The UK, currently in the throes of an election campaign, is likely to find the limelight too.

On Tuesday, labor-market data in Britain may show an uptick in pay growth. And the next day, gross domestic product numbers probably failed to rise in April for the first time this year, signaling a poor start to the second quarter.

Fed Chair Jerome Powell has repeatedly assured that, with the benchmark rate around 5.33% — the highest in more than two decades — the current stance is restrictive and will indeed bring inflation back to 2% in time.

Others have doubts, pointing to the resilience of both the economy and the financial system. Even within the Fed there's some skepticism. Dallas Fed President Lorie Logan said May 30 that it "may be that policy is just not as restrictive as we think it might have been relative to the level of interest rates before the pandemic."

Speaking ahead of the policy communications blackout period ahead of the Fed's June 11-12 meeting, Logan urged keeping "all options on the table."

Friday's jobs report for May would surely have reinforced her doubts.

Employers added 272,000 new jobs in May, exceeding all estimates in a Bloomberg survey. On top of that, average hourly earnings over the past 12 months ticked up after three straight declines that had begun to reassure the central bank.

The figures reopened "the door a little bit wider on the debate over whether or not policy is indeed as restrictive as the Fed thinks it is," BlackRock Inc.'s Jeffrey Rosenberg said on Bloomberg Television.

Treasuries sold off and the dollar strengthened after the report. Interest-rate futures suggested diminishing confidence among traders that Powell and his colleagues will lower rates twice this year, by a cumulative 50 basis points.

Policymakers at this week's meeting will update their projections for where they see their benchmark at year-end and over the longer haul. Economists are divided on what they're likely to do with that so-called dot-plot.

A 41% plurality of economists expect the Fed to signal two cuts for this year, while an equal number expect the forecasts to show just one or no cuts at all, a Bloomberg survey shows. Back in March, the Fed was still penciling in three reductions by year-end.

The Best of Bloomberg Economics

The European Central Bank may not cut rates again for a while as it watches to see how quickly inflation recedes, Joachim Nagel said.

Brazil's central bank chief said the country's neutral structural interest rate is high and it's important to fight the cause of that.

Climate change in the UK is delivering extreme weather, creating a headache for economists trying to predict retail and growth data.

From bust to boom: Greece, Spain and Portugal were once Europe's economic basket cases — not any more.

Support for Australian Prime Minister Anthony Albanese's party is slumping after a weak growth figures.

Japan's big business lobby said current laws that effectively force married women to go by their husbands' names for present a business risk.

The Week Ahead

After this week's Fed decision, the Bank of Japan will grab the spotlight Friday when its board concludes a two-day meeting with a policy decision.

While the bank is expected to hold its short-term rate steady, people familiar with the matter have said officials may discuss whether to reduce bond purchases.

Source: Bloomberg

Inflation figures due from China to Sweden will also draw the attention of traders. The UK, currently in the throes of an election campaign, is likely to find the limelight too.

On Tuesday, labor-market data in Britain may show an uptick in pay growth. And the next day, gross domestic product numbers probably failed to rise in April for the first time this year, signaling a poor start to the second quarter.

No comments