Modi 3.0

Prime Minister Narendra Modi's pledge to make India a developed country by the centenary of independence in 2047 was central to his reelection bid.

Delivering on that promise has just got that much harder.

Economists say it's going to take 8%-plus GDP growth for the next quarter century to get there. That's in the league of the "China Miracle" expansion from the 1980s through to 2010 — and it's called a miracle for a reason.

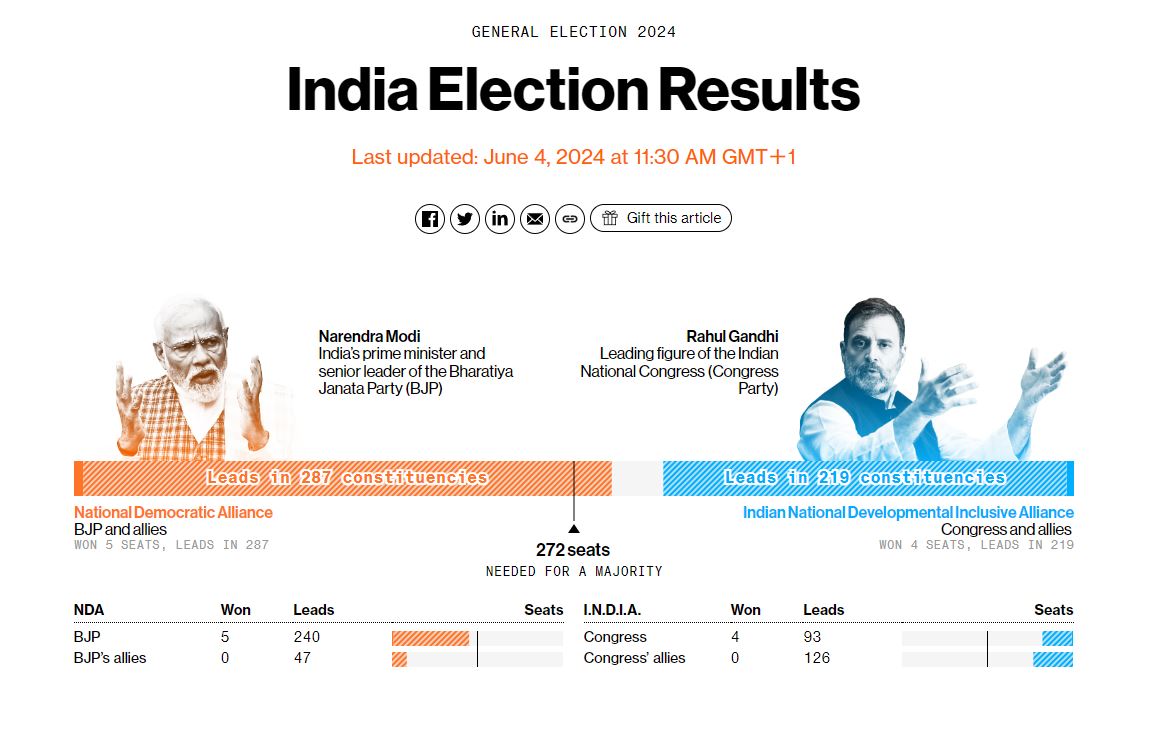

The latest counting signals only a narrow win for Modi's Bharatiya Janata Party, which may make it harder to push through tough reforms to the agriculture sector and land acquisition rules that would have helped facilitate large-scale manufacturing efforts.

Past efforts to rein in the fiscal deficit, curb government debt and boost tax revenues have helped Modi fund his ambitious infrastructure build-out (as we wrote last week). Economists now worry a slimmer victory will mean he needs to boost welfare spending at the upcoming budget.

Investors had been betting on a Modi landslide, especially on Monday after exit polls pointed in that direction. Stocks, bonds and the rupee are tumbling Tuesday as a tighter result now appears likely.

For more: 2024 India Election Results: Live Updates, Maps

Then there's the jobs challenge. Half of India's 1.4 billion population is below the age of 30, which is one of the reasons some are so bullish on its growth prospects. But finding employment for all those people has proven too tough for Modi so far. The Centre for Monitoring Indian Economy, a private research company, estimates the unemployment rate of those between ages of 20-24 years is 42.6%.

Any backsliding on reforms is only going to make it even tougher for Modi to deliver on his goal to join the ranks of the world's developed economies.

"India needs to remain steadfast on structural reforms like land and labor market reforms while creating a conducive environment for millions of workers to be gainfully employed, to realize its true growth potential," economists at Goldman Sachs wrote in a note.

Need-to-Know Research

In the latest illustration of how high interest rates are impacting the US housing market, Goldman Sachs in its mid-year outlook warned that existing home sales are set for the weakest year since the early 1990s.

With almost 80% of mortgage borrowers having loans that are more than 2 percentage points below current rates, there's a significant financial disincentive to selling. And limits on available plots and worker shortages impose constraints on new housing construction, Goldman senior economist Ronnie Walker wrote in a note Sunday.

Meantime, builders are cutting back on multi-family construction to work off a big backlog of apartment units. Bottom line: Goldman cut its residential fixed investment forecast to 2.1% for the fourth quarter of 2024 from a year before — from 5.6% previously. And that shaves the year's GDP growth estimate by 0.1 percentage point, to 2.3%.

Delivering on that promise has just got that much harder.

Economists say it's going to take 8%-plus GDP growth for the next quarter century to get there. That's in the league of the "China Miracle" expansion from the 1980s through to 2010 — and it's called a miracle for a reason.

The latest counting signals only a narrow win for Modi's Bharatiya Janata Party, which may make it harder to push through tough reforms to the agriculture sector and land acquisition rules that would have helped facilitate large-scale manufacturing efforts.

Past efforts to rein in the fiscal deficit, curb government debt and boost tax revenues have helped Modi fund his ambitious infrastructure build-out (as we wrote last week). Economists now worry a slimmer victory will mean he needs to boost welfare spending at the upcoming budget.

Investors had been betting on a Modi landslide, especially on Monday after exit polls pointed in that direction. Stocks, bonds and the rupee are tumbling Tuesday as a tighter result now appears likely.

For more: 2024 India Election Results: Live Updates, Maps

Then there's the jobs challenge. Half of India's 1.4 billion population is below the age of 30, which is one of the reasons some are so bullish on its growth prospects. But finding employment for all those people has proven too tough for Modi so far. The Centre for Monitoring Indian Economy, a private research company, estimates the unemployment rate of those between ages of 20-24 years is 42.6%.

Any backsliding on reforms is only going to make it even tougher for Modi to deliver on his goal to join the ranks of the world's developed economies.

"India needs to remain steadfast on structural reforms like land and labor market reforms while creating a conducive environment for millions of workers to be gainfully employed, to realize its true growth potential," economists at Goldman Sachs wrote in a note.

Need-to-Know Research

In the latest illustration of how high interest rates are impacting the US housing market, Goldman Sachs in its mid-year outlook warned that existing home sales are set for the weakest year since the early 1990s.

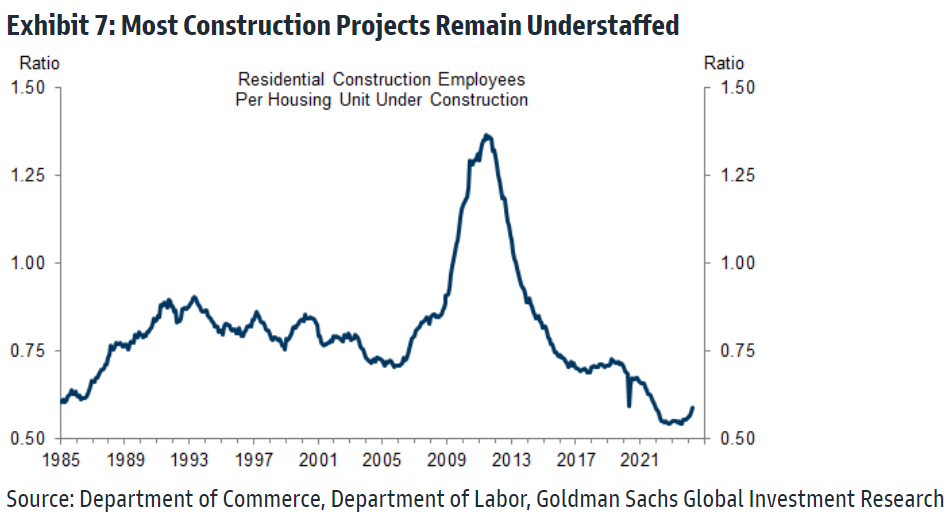

With almost 80% of mortgage borrowers having loans that are more than 2 percentage points below current rates, there's a significant financial disincentive to selling. And limits on available plots and worker shortages impose constraints on new housing construction, Goldman senior economist Ronnie Walker wrote in a note Sunday.

|

Meantime, builders are cutting back on multi-family construction to work off a big backlog of apartment units. Bottom line: Goldman cut its residential fixed investment forecast to 2.1% for the fourth quarter of 2024 from a year before — from 5.6% previously. And that shaves the year's GDP growth estimate by 0.1 percentage point, to 2.3%.

No comments