Trump vs Powell

Vexed by an October 2018 stock market slump, then President Donald Trump declared: "The Fed is going loco" with its interest-rate increases.

Days later, he stepped up his attacks, saying he "maybe" regretted appointing its chairman, Jerome Powell. And the invective just kept flowing — Bloomberg News kept a running tally, which you can find here.

Come November, our reporters might just have to dust off that file if Trump keeps his nose ahead in the race against President Joe Biden and reclaims the Oval Office.

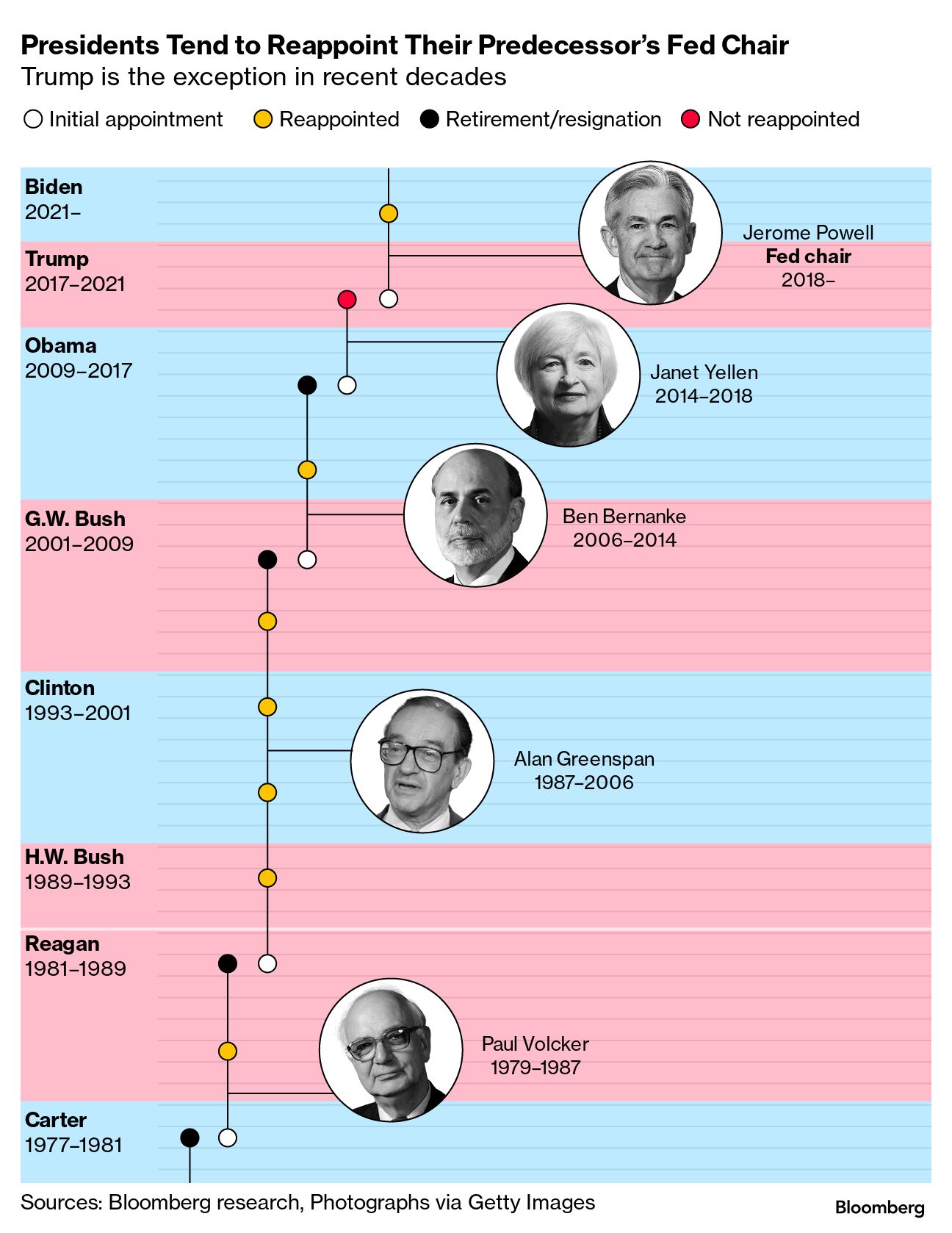

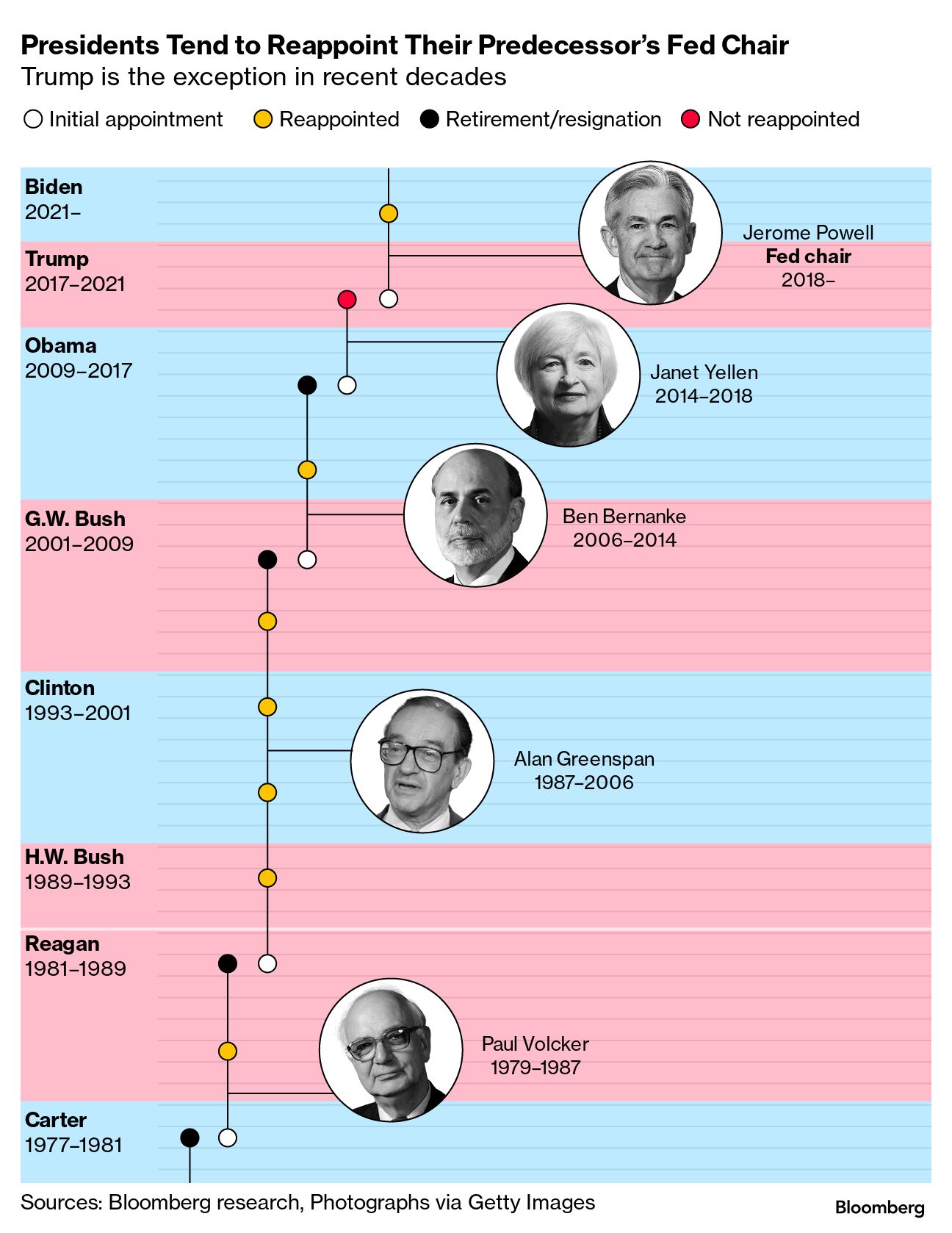

Trump has already said he wouldn't reappoint Powell. That would match his decision as president not to extend then chair Janet Yellen's tenure.

Sources: Bloomberg research, Photographs via Getty Images

As Bloomberg Businessweek reports, some informal Trump advisers have floated ideas about possible changes to the Fed that would give him more power over the central bank.

One way to do that would be by changing the personnel. The President's most direct power over the Fed is through naming appointees to fill vacancies on the Board of Governors and appointing them to key positions, including chair, on that body.

Biden reappointed Powell to a new four-year term as chairman in 2021, which means that term expires in 2026. If Trump doesn't try to sack him first (which may not be legally possible), he could just wait for the clock to run down, though he'd still be stuck with Powell as a Fed governor till that 14-year term ends in 2028.

Including Powell's expiring governor term, Trump would have two chances to name appointees to the Fed board, in 2026 and 2028. But that represents a small slice of the 12-member FOMC, which is made up of all Fed governors and a rotation of officers from the 12 regional Fed banks.

A longer-term project to reshape the Fed would involve amending the law that created it, which would require an act of Congress.

The Heritage Foundation, a conservative think tank, included several such recommendations in a document that is part of its Project 2025, which aims to set a policy agenda for the next president.

It calls for changes that would put more constraints around how the Fed sets policy and regulates the largest banks. It suggests the Fed's dual mandate — bestowed upon it by Congress — of fostering both stable prices and maximum employment should be changed to focus only on inflation.

Such a unitary focus may well have led to an earlier policy response to the inflation outbreak that started in 2021.

Whether that's loco or not I'll leave up to you.

The Best of Bloomberg Economics

Coming up: Brazil will likely pause rates cuts. Early tomorrow, Switzerland delivers a nail-biter decision, followed by Norway.

Fed officials emphasized the need for more evidence of cooling inflation before lowering rates, with some offering insight on timing.

Bank of Japan officials discussed the possibility of pursuing a faster pace of policy normalization amid weakness in the yen, minutes show.

Chile's central bank slowed rate cuts, while money markets now see a 20% chance that Australia's will raise borrowing costs again.

Britain's soaring homeless population has emerged as another symptom of a crisis in housing that's pushed the issue up the political agenda.

The new episode of Voternomics looks at the rise of Italy's Giorgia Meloni and what's behind the far-right's electoral success across the continent.

Need-to-Know Research

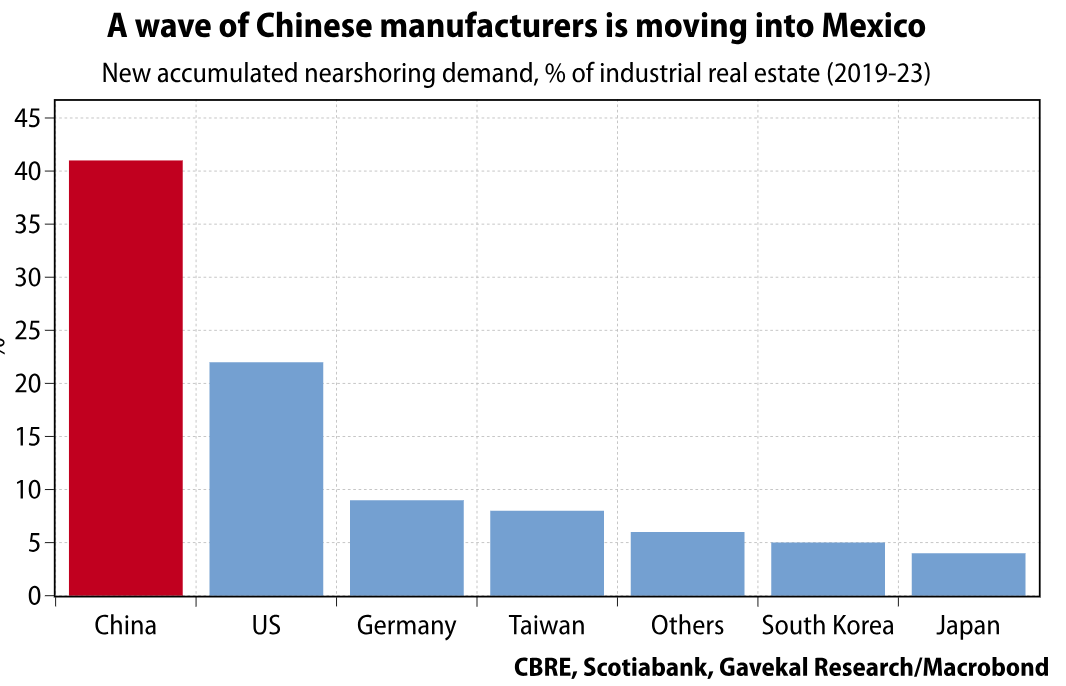

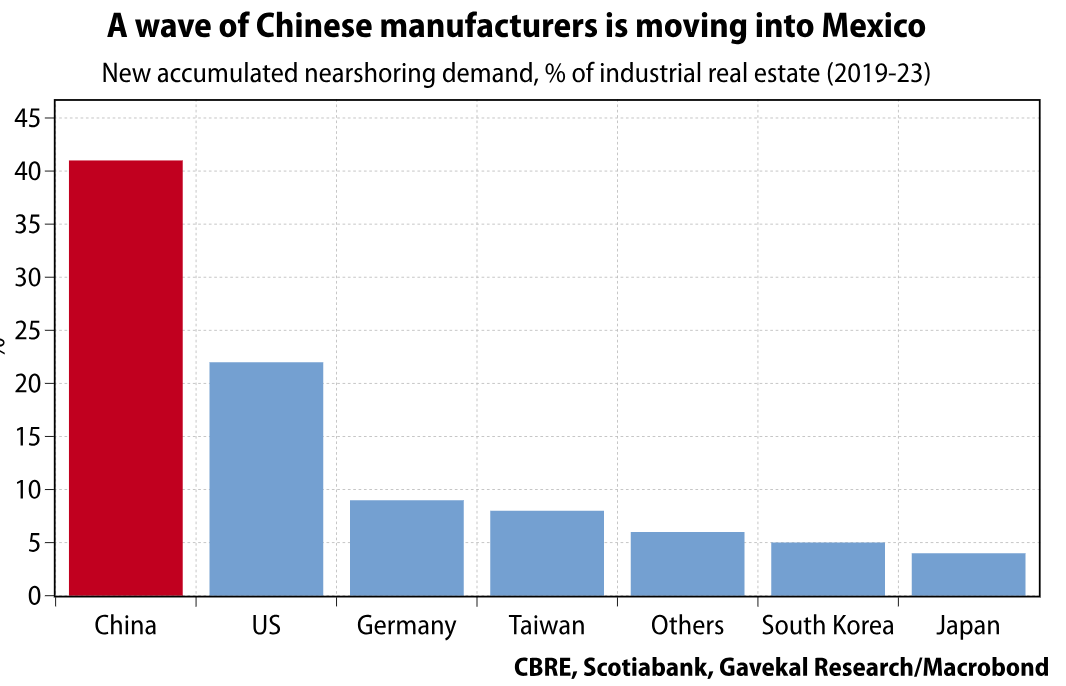

It's not by design, but Mexico is now finding itself "at the heart of the US-China strategic rivalry" as Chinese companies seek to shield themselves from the impact of Washington's trade restrictions, says Tom Miller, a senior analyst at Gavekal Research.

"The increase in Mexican exports to the US last year was roughly matched by the rise in Chinese imports to Mexico, which suggests some rerouting," Miller highlighted in a note Tuesday. Chinese manufacturing investments also accelerated after then-US President Donald Trump slapped sanctions on Chinese imports.

Strict local-content rules are likely to limit the amount of production Chinese companies can ship to Mexico for final assembly and export to the US, Miller wrote. While that would further incentivize investment into Mexico, US political opposition to increased Chinese-owned firms may make that tricky.

Miller says: "Mexico is uniquely well-positioned to benefit from nearshoring, but its deep dependence on the US leaves it exposed."

Days later, he stepped up his attacks, saying he "maybe" regretted appointing its chairman, Jerome Powell. And the invective just kept flowing — Bloomberg News kept a running tally, which you can find here.

Come November, our reporters might just have to dust off that file if Trump keeps his nose ahead in the race against President Joe Biden and reclaims the Oval Office.

Trump has already said he wouldn't reappoint Powell. That would match his decision as president not to extend then chair Janet Yellen's tenure.

Sources: Bloomberg research, Photographs via Getty Images

As Bloomberg Businessweek reports, some informal Trump advisers have floated ideas about possible changes to the Fed that would give him more power over the central bank.

One way to do that would be by changing the personnel. The President's most direct power over the Fed is through naming appointees to fill vacancies on the Board of Governors and appointing them to key positions, including chair, on that body.

Biden reappointed Powell to a new four-year term as chairman in 2021, which means that term expires in 2026. If Trump doesn't try to sack him first (which may not be legally possible), he could just wait for the clock to run down, though he'd still be stuck with Powell as a Fed governor till that 14-year term ends in 2028.

Including Powell's expiring governor term, Trump would have two chances to name appointees to the Fed board, in 2026 and 2028. But that represents a small slice of the 12-member FOMC, which is made up of all Fed governors and a rotation of officers from the 12 regional Fed banks.

A longer-term project to reshape the Fed would involve amending the law that created it, which would require an act of Congress.

The Heritage Foundation, a conservative think tank, included several such recommendations in a document that is part of its Project 2025, which aims to set a policy agenda for the next president.

It calls for changes that would put more constraints around how the Fed sets policy and regulates the largest banks. It suggests the Fed's dual mandate — bestowed upon it by Congress — of fostering both stable prices and maximum employment should be changed to focus only on inflation.

Such a unitary focus may well have led to an earlier policy response to the inflation outbreak that started in 2021.

Whether that's loco or not I'll leave up to you.

The Best of Bloomberg Economics

Coming up: Brazil will likely pause rates cuts. Early tomorrow, Switzerland delivers a nail-biter decision, followed by Norway.

Fed officials emphasized the need for more evidence of cooling inflation before lowering rates, with some offering insight on timing.

Bank of Japan officials discussed the possibility of pursuing a faster pace of policy normalization amid weakness in the yen, minutes show.

Chile's central bank slowed rate cuts, while money markets now see a 20% chance that Australia's will raise borrowing costs again.

Britain's soaring homeless population has emerged as another symptom of a crisis in housing that's pushed the issue up the political agenda.

The new episode of Voternomics looks at the rise of Italy's Giorgia Meloni and what's behind the far-right's electoral success across the continent.

Need-to-Know Research

It's not by design, but Mexico is now finding itself "at the heart of the US-China strategic rivalry" as Chinese companies seek to shield themselves from the impact of Washington's trade restrictions, says Tom Miller, a senior analyst at Gavekal Research.

"The increase in Mexican exports to the US last year was roughly matched by the rise in Chinese imports to Mexico, which suggests some rerouting," Miller highlighted in a note Tuesday. Chinese manufacturing investments also accelerated after then-US President Donald Trump slapped sanctions on Chinese imports.

Strict local-content rules are likely to limit the amount of production Chinese companies can ship to Mexico for final assembly and export to the US, Miller wrote. While that would further incentivize investment into Mexico, US political opposition to increased Chinese-owned firms may make that tricky.

Miller says: "Mexico is uniquely well-positioned to benefit from nearshoring, but its deep dependence on the US leaves it exposed."

No comments