Inject stimulus here

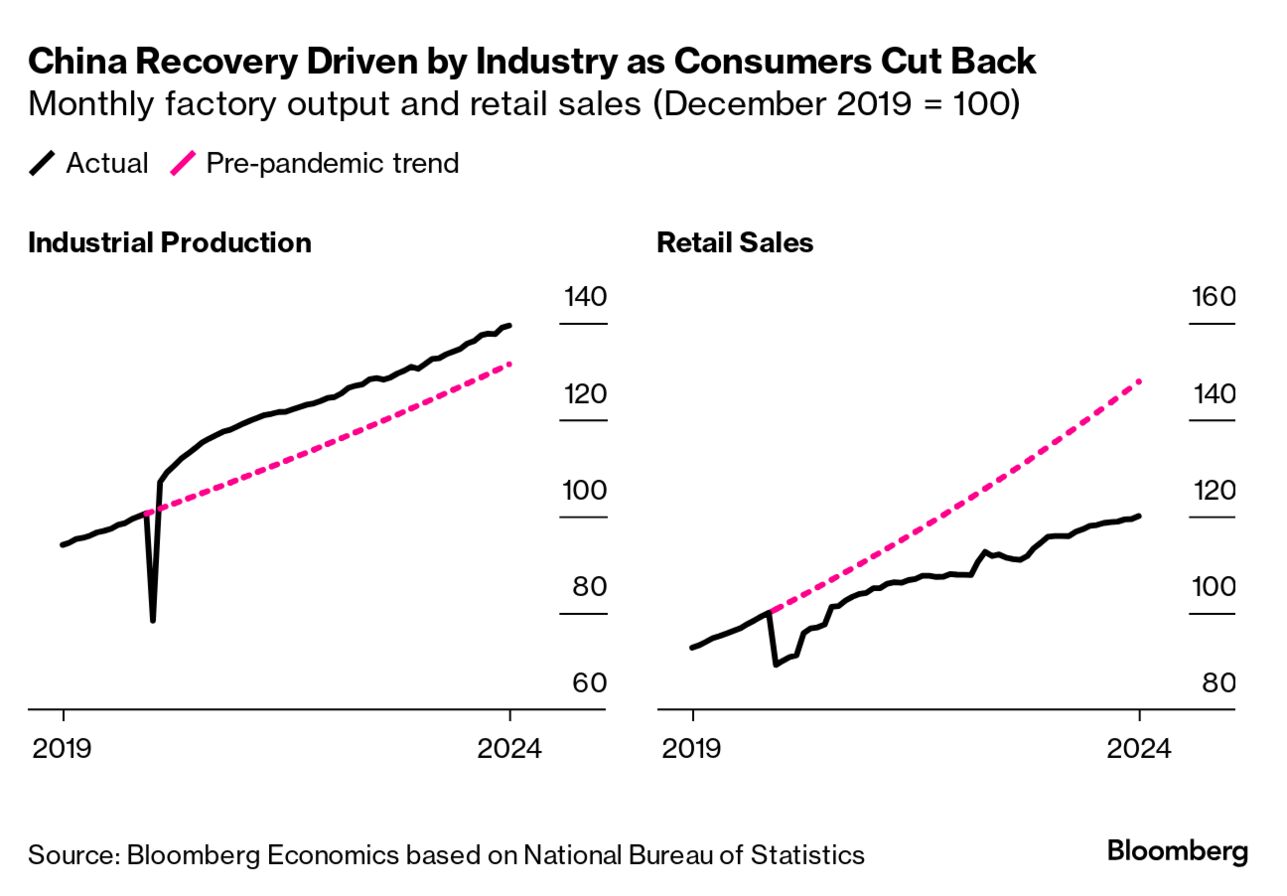

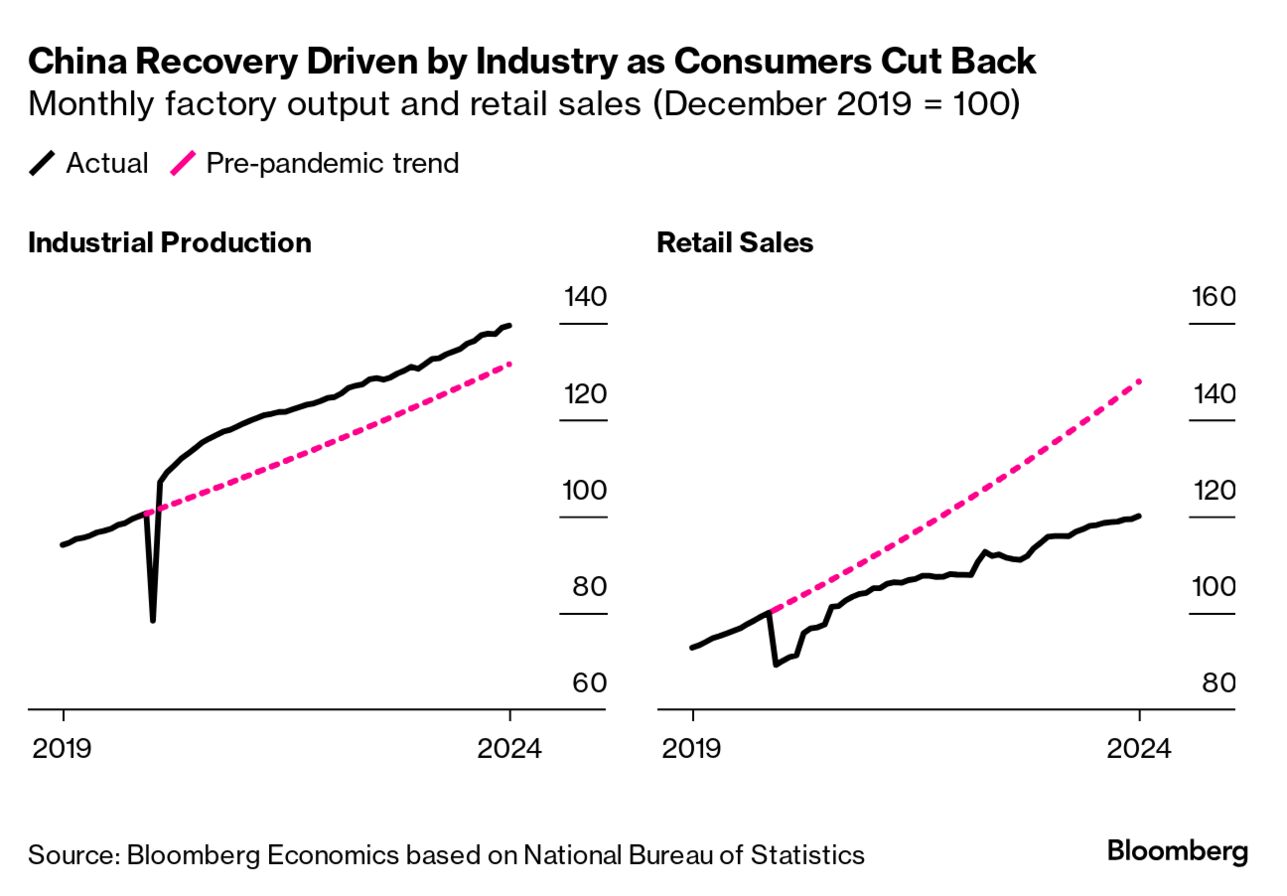

One overarching message from the stream of data out of China Monday is that more stimulus is needed.

Activity in the closely-watched real estate sector decelerated further in May, with development investment falling to a 2020 pace and prices of new homes plunging the most since late 2014. Industrial production was also surprisingly weaker than expected.

These figures come after several large-scale measures from the government to boost domestic demand. Most recently, officials announced $42 billion in funding for local governments to buy up excess inventory from developers. That's after a slew of other measures in recent years, including easing mortgage rules and cutting downpayment requirements.

But even steady retail sales can't mask the weak activity, confirming

economists' earlier suspicions that these measures just wouldn't be enough.

Monetary policy isn't likely to help anytime soon. The PBOC held the policy rate as widely expected Monday and forecasters don't see a cut until the second half of the year. Yes, easing policy would spur growth but it also threatens to weaken the currency, and president Xi Jinping has said yuan stability is a priority.

(Policymakers also don't really need to use that blunt rate tool as long as at least one leg of the economy is driving growth; right now that's exports and production.)

That leaves the fiscal side. All eyes are now turning to July's third plenum, perhaps the most important annual meeting where China's communist party officials broadcast a policy roadmap.

Every major analyst out there says additional measures are needed if officials want to reach their 5% growth goal this year and stabilize the economy.

And Xi hinted reforms may target housing and the labor market. The risk, of course, is that — as recent experience has shown — it still won't be enough.

The Best of Bloomberg Economics

The US has nabbed almost one-third of all the investment that flowed across borders since Covid struck.

China launched an anti-dumping probe on pork imports from the European Union amid simmering trade tensions.

More and more Germans can't make ends meet as the shocks of recent years gradually work their way through Europe's largest economy.

For bond traders, data matters more than what the Fed is saying.

Hong Kong and Singapore are the world's priciest cities for expats

Brazil central bank is facing an emergency of its own making that threatens to sabotage years of deft policy making.

Participate in Our Survey

Where do you expect oil and gold to trade at the end of this year? Which is a bigger risk to the US economy right now: a pickup in inflation or an increase in unemployment? Which assets are most overpriced? Share your views in a quick, anonymous survey.

The Week Ahead

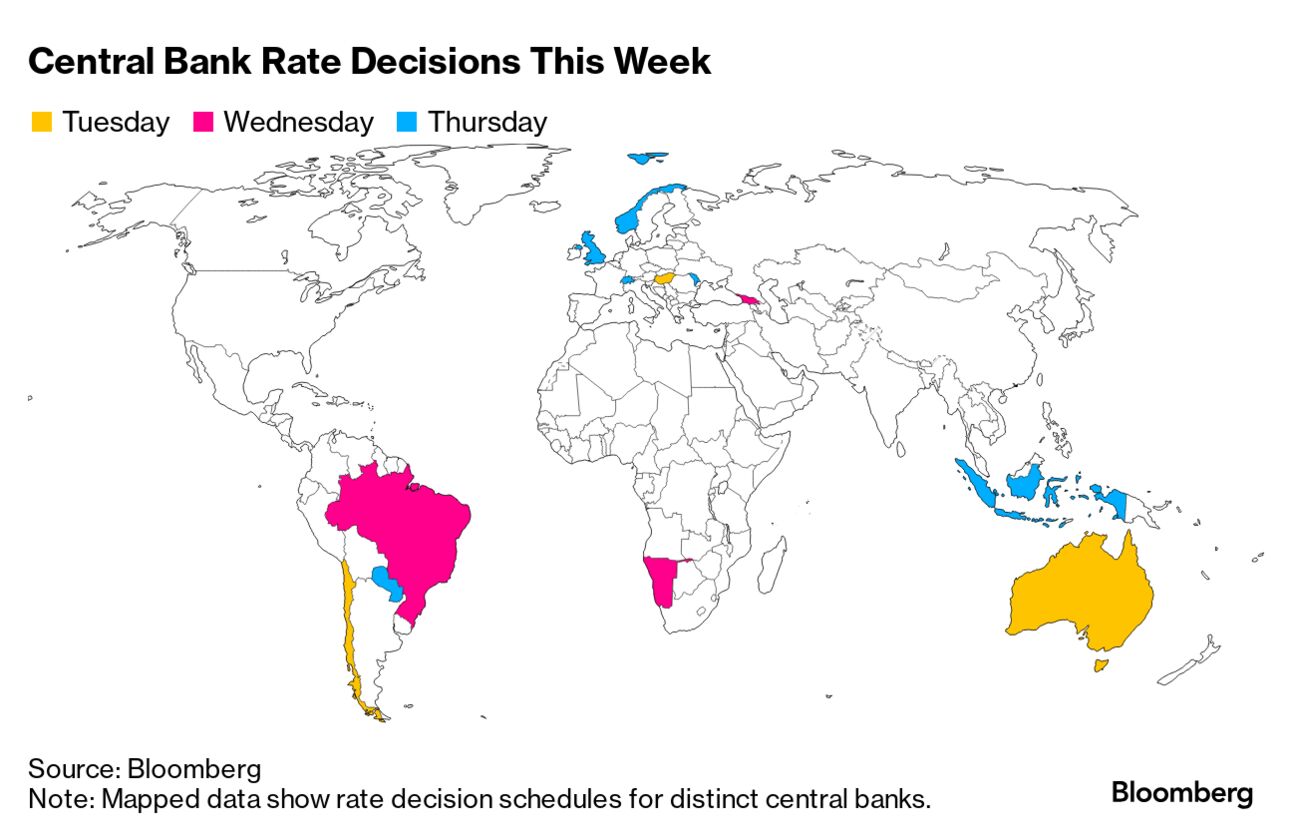

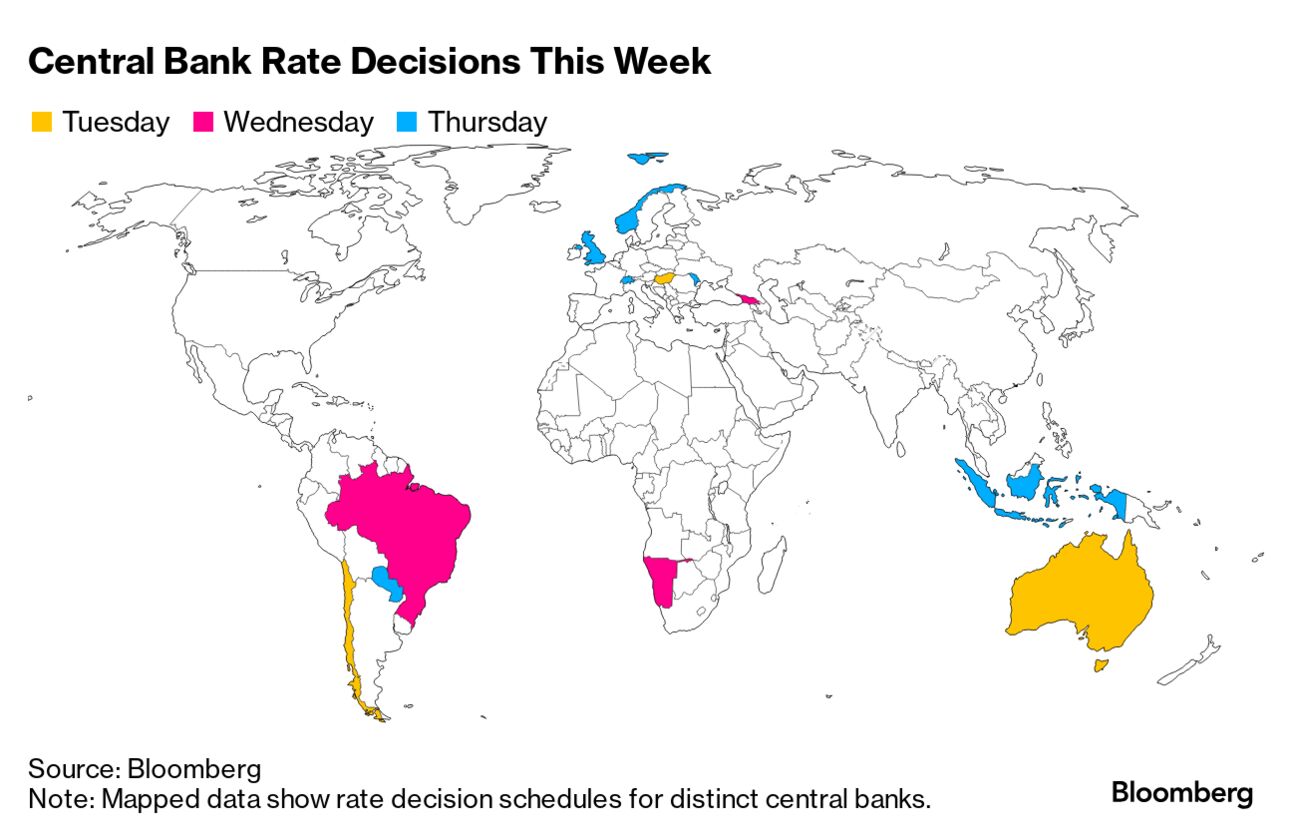

Central banks cagey about joining the global rate cutting cycle may reveal themselves this week with a quartet of decisions in advanced economies.

Days after the Federal Reserve pared back projections for US monetary easing this year, policymakers from the UK to Australia are likely to signal that they're still not convinced enough about disinflation to start lowering borrowing costs themselves.

See here for the rest of the week's economic events.

Need-to-Know Research

In their latest monthly global outlook, Citigroup economists led by Nathan Sheets discuss a potential shift in consumer behavior — in favor of buying more goods and trimming back on services — that could help to alleviate inflation.

The reason for the shift: "consumer goods purchased in the 2020-21 pandemic spending boom are depreciating and will need to be replaced," the Citigroup team wrote in a note last week. "This rotation should help take the heat out of labor markets, since manufacturing is less labor-intensive than services, and thus temper services inflation."

"We will be closely watching developments in services spending and the composition of consumer spending more generally through this summer's vacation season," the Citi economists wrote. The bank expects CPI inflation in advanced economies as a group to step down to 2.5% this year and 2.1% in 2025, from 4.4% last year.

Activity in the closely-watched real estate sector decelerated further in May, with development investment falling to a 2020 pace and prices of new homes plunging the most since late 2014. Industrial production was also surprisingly weaker than expected.

These figures come after several large-scale measures from the government to boost domestic demand. Most recently, officials announced $42 billion in funding for local governments to buy up excess inventory from developers. That's after a slew of other measures in recent years, including easing mortgage rules and cutting downpayment requirements.

But even steady retail sales can't mask the weak activity, confirming

economists' earlier suspicions that these measures just wouldn't be enough.

Monetary policy isn't likely to help anytime soon. The PBOC held the policy rate as widely expected Monday and forecasters don't see a cut until the second half of the year. Yes, easing policy would spur growth but it also threatens to weaken the currency, and president Xi Jinping has said yuan stability is a priority.

(Policymakers also don't really need to use that blunt rate tool as long as at least one leg of the economy is driving growth; right now that's exports and production.)

That leaves the fiscal side. All eyes are now turning to July's third plenum, perhaps the most important annual meeting where China's communist party officials broadcast a policy roadmap.

Every major analyst out there says additional measures are needed if officials want to reach their 5% growth goal this year and stabilize the economy.

And Xi hinted reforms may target housing and the labor market. The risk, of course, is that — as recent experience has shown — it still won't be enough.

The Best of Bloomberg Economics

The US has nabbed almost one-third of all the investment that flowed across borders since Covid struck.

China launched an anti-dumping probe on pork imports from the European Union amid simmering trade tensions.

More and more Germans can't make ends meet as the shocks of recent years gradually work their way through Europe's largest economy.

For bond traders, data matters more than what the Fed is saying.

Hong Kong and Singapore are the world's priciest cities for expats

Brazil central bank is facing an emergency of its own making that threatens to sabotage years of deft policy making.

Participate in Our Survey

Where do you expect oil and gold to trade at the end of this year? Which is a bigger risk to the US economy right now: a pickup in inflation or an increase in unemployment? Which assets are most overpriced? Share your views in a quick, anonymous survey.

The Week Ahead

Central banks cagey about joining the global rate cutting cycle may reveal themselves this week with a quartet of decisions in advanced economies.

Days after the Federal Reserve pared back projections for US monetary easing this year, policymakers from the UK to Australia are likely to signal that they're still not convinced enough about disinflation to start lowering borrowing costs themselves.

See here for the rest of the week's economic events.

Need-to-Know Research

In their latest monthly global outlook, Citigroup economists led by Nathan Sheets discuss a potential shift in consumer behavior — in favor of buying more goods and trimming back on services — that could help to alleviate inflation.

The reason for the shift: "consumer goods purchased in the 2020-21 pandemic spending boom are depreciating and will need to be replaced," the Citigroup team wrote in a note last week. "This rotation should help take the heat out of labor markets, since manufacturing is less labor-intensive than services, and thus temper services inflation."

"We will be closely watching developments in services spending and the composition of consumer spending more generally through this summer's vacation season," the Citi economists wrote. The bank expects CPI inflation in advanced economies as a group to step down to 2.5% this year and 2.1% in 2025, from 4.4% last year.

No comments